Market Overview

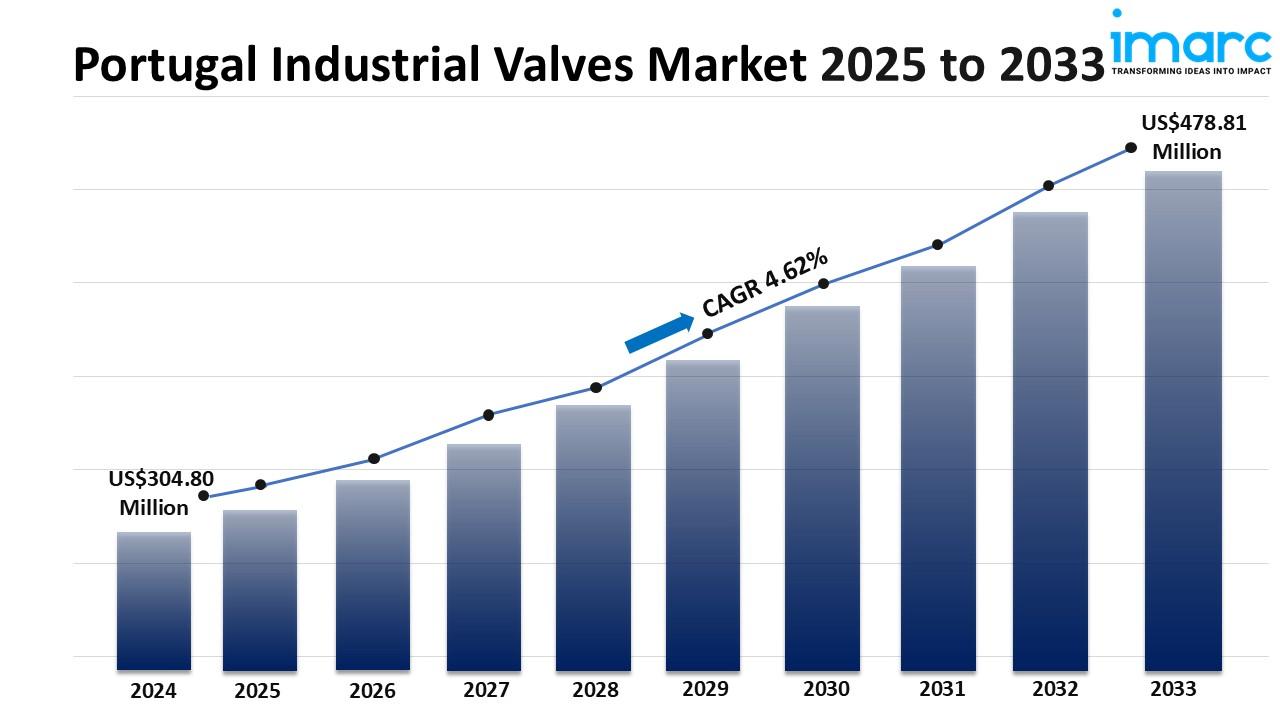

The Portugal industrial valves market reached a size of USD 304.80 Million in 2024 and is expected to grow to USD 478.81 Million by 2033, with a CAGR of 4.62% during the forecast period 2025-2033. The market's growth is driven by Portugal's diversified industrial sectors such as machinery, automotive, petrochemicals, and food processing. Technological advancements like smart valve integration and automation are enhancing operational efficiency and safety. Additionally, stringent environmental regulations are boosting demand for energy-efficient and green valve solutions.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

Portugal Industrial Valves Market Key Takeaways

- Current Market Size: USD 304.80 Million (2024)

- CAGR: 4.62% (2025-2033)

- Forecast Period: 2025-2033

- The market growth is fueled by continuous infrastructure development in major sectors, notably with government investments in water treatment and distribution upgrades.

- Technological innovations such as IoT-enabled smart valves are driving operational efficiency and predictive maintenance.

- Regulatory frameworks emphasizing environmental sustainability are promoting the adoption of energy-efficient and durable valve products.

- The rise in industrial activities in energy, manufacturing, and utilities sustains demand for high-quality valves.

- The market benefits from government pledges and initiatives to modernize infrastructure, supporting innovation and expansion.

Sample Request Link: https://www.imarcgroup.com/portugal-industrial-valves-market/requestsample

Market Growth Factors

Development of infrastructure is one of the key growth drivers of the Portuguese market. For instance, in March 2025, the government announced it would invest a lot to upgrade the national water treatment and distribution infrastructure. Strong and reliable valve systems are essential within large scale fluid systems, and the continued use of high-tech industrial valves is required to update existing, aging plants to meet elevated operating and environmental standards. Growing industrial sectors, like energy, manufacturing, and utilities, have driven the demand for valves in order to secure and protect their systems. For valve manufacturers and suppliers, these infrastructure investments open up numerous opportunities to grow and diversify.

The operation of industrial valves has also been improved by technological advances, such as connecting the valve systems to sensors from IoT devices in Portugal. This allows maintenance to be predicted and downtime to be reduced, and lowers the cost of operation. In June 2024, the Portuguese Minister of Industry announced that the plan will focus upon the implementation of Industry 4.0 technologies, especially automating and manufacturing smartly, to improve energy, water and chemical processes. More digital solutions in valves should improve the valve systems' reliability and sustainability through minimized use of natural resources. These trends should increase the demand for advanced valves. This increase will drive market growth.

In Portugal, regulators plan to set rules so industrial equipment makes the valve market more sustainable. In July 2024 the Portuguese Environmental Agency created new rules. The rules reduce greenhouse gas emissions and consume less energy in industrial facilities. To treat water, process chemicals, and generate electricity, industries use valves that must now endure more, use energy efficiently, and be environmentally friendly. A range of valves designed to minimize leakage and maximize energy efficiency have been developed in response. These regulations set the stage for green valve solutions for national industries to be developed along with global sustainability goals, creating sustainable and resilient long-term markets.

Market Segmentation

Product Type Insights:

- Gate Valve: Includes valves that control flow by lifting a gate out of the fluid path, commonly used for on-off control.

- Globe Valve: Valves designed for throttling flow and regulating fluid in pipelines.

- Butterfly Valve: Compact valves using a rotating disc for flow control, suitable for quick shut-off.

- Ball Valve: Utilizes a spherical ball to control flow, providing reliable sealing and quick operation.

- Check Valve: Prevents backflow in piping systems by allowing flow in one direction only.

- Plug Valve: Employs a cylindrical or conical plug for regulating fluid flow.

- Others: Includes miscellaneous types of industrial valves not classified above.

Functionality Insights:

- On-Off/Isolation Valves: Valves designed to start or stop flow completely, serving as isolation devices.

- Control Valves: Valves that modulate flow rate, pressure, or temperature to maintain process control.

Material Insights:

- Steel: Valves manufactured from steel, offering strength and durability for industrial applications.

- Cast Iron: Valves made of cast iron, typically used where corrosion resistance and strength are required.

- Alloy Based: Valves composed of specialized alloys to enhance corrosion resistance and mechanical properties.

- Others: Valves made from other materials aside from steel, cast iron, or alloys.

Size Insights:

- Up to 1”: Valves with a size of one inch or less, appropriate for small-scale applications.

- 1”–6”: Valves ranging from one to six inches, common in medium-scale systems.

- 7”–25”: Valves sized between seven and twenty-five inches, used for larger pipe diameters.

- 26”–50”: Large valves fitting pipeline sizes from twenty-six to fifty inches.

- 51” and Above: Extra-large valves exceeding fifty-one inches in size.

End Use Industry Insights:

- Oil and Gas: Valves utilized in exploration, production, and refining processes.

- Power: Valves used in power generation plants and related infrastructure.

- Pharmaceutical: Specialized valves for pharmaceutical manufacturing requiring high purity.

- Water and Wastewater Treatment: Valves for municipal and industrial water treatment and distribution.

- Chemical: Valves designed to handle corrosive and reactive chemicals safely.

- Food and Beverage: Valves compliant with hygiene standards for food and beverage processing.

- Others: Additional industries using industrial valves not specified above.

Regional Insights

The report segments Portugal into regions including Norte, Centro, A. M. Lisboa, Alentejo, and others. The dominant region is not explicitly stated in terms of market share or CAGR in the source. Hence, specific market statistics per region are not provided.

Recent Developments & News

In July 2025, KLINGER Portugal developed an innovative textile wastewater treatment system for Quinta e Santos Score, S.A., aiming to reuse at least 40% of treated water. The five-stage facility combines physical, chemical, and biological processes to meet stringent quality standards while enhancing operational efficiency. Completed in six months, this project highlights KLINGER Portugal's leadership in sustainable water management aligned with national environmental goals.

Competitive Landscape

The competitive landscape of the industry has also been examined along with the profiles of the key players.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302