Polymers for 3D printing market size come in a wide range of chemistries, including commodity plastics and high-performance thermoplastics and composites. These materials support the main additive manufacturing (AM) processes: FDM/FFF (filament extrusion), SLA/Vat Polymerization (liquid resins), SLS/Selective Powder processes, and material jetting techniques.

In the early days of AM, PLA and ABS were dominant because they were easy to process and cost-effective. However, as 3D printing shifts from prototyping to end-use manufacturing, the demand is increasingly directed toward higher-performance materials like PEEK, PEKK, ULTEM, carbon-reinforced composites, and specialty polyimides. One challenge in this developing area is that not all printers can process the newer materials, which may require higher temperatures, controlled environments, or specialized nozzles. The industry is addressing this issue through collaboration between material and hardware manufacturers to ensure compatibilityAnother factor limiting growth is scaling constraints. The physical size of printer build chambers, the expense of large-volume parts, warping, shrinkage behavior, and intellectual property or licensing problems all pose challenges to the widespread use of high-performance polymers.

Overall, the polymers for 3D printing market is evolving from simple plastic prototyping to reliable, functional production-grade materials. This change is creating opportunities for material innovators, printer OEMs, industrial users, and service providers.

📌 Download your Sample Report Instantly - Corporate Email ID required for priority access:- https://www.datamintelligence.com/download-sample/polymers-for-3d-printing-market

Market Segmentation

The DataM Intelligence report segments the polymers for 3D printing market across several dimensions. Here is an overview:

By Type

The "type" segmentation includes polycarbonate, polyether ester ketone (PEEK/PEKK), photopolymer (resins), acrylonitrile butadiene styrene (ABS), polyetherimide (ULTEM, etc.), polyamide/nylon, and others. DataM Intelligence

ABS is still widely used because it is relatively inexpensive, strong, and compatible with many FDM systems. DataM Intelligence However, higher performance polymers are increasingly preferred in applications that require thermal stability, strength, and chemical resistance, such as medical implants and aerospace parts. DataM Intelligence

By Form

This dimension divides the market into filament, liquid, and powder forms. DataM Intelligence

• Filament is the main form used in FDM/FFF printing.

• Powder is essential for SLS/powder bed fusion techniques.

• Liquid/resin types are used in SLA and other vat polymerization processes.

By Process

The report categorizes polymers by material extrusion, vat polymerization, powder bed fusion, and material jetting. DataM Intelligence

Each process has different constraints and suitable polymer chemistries; for example, some polymers in filament form may not work well in powder processes.

By Application

The main application segments are prototyping and manufacturing (end-use parts). DataM Intelligence

While prototyping continues to hold a significant share, there is a shift toward manufacturing, which is increasing the demand for performance, reliability, repeatability, and certification in polymer materials.

By End User/Vertical

The market is also segmented into healthcare, aerospace & defense, automotive, electrical & electronics, and others. DataM Intelligence

These sectors have different regulatory requirements, performance needs, certification cycles, and volume expectations. For example, healthcare and aerospace require the highest levels of quality, biocompatibility, and traceability.

📌 Speak to Our Senior Analyst and Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/polymers-for-3d-printing-market

Market Drivers

Several interconnected drivers are influencing the polymers for 3D printing market. Key ones include:

1. Demand for high-performance thermoplastics and composite materials

As industries shift from prototyping to functional parts, polymers that offer thermal stability, mechanical strength, chemical resistance, and durability are becoming essential. DataM Intelligence Materials such as PEEK, PEKK, carbon-reinforced filaments, and specialty polyimides are increasingly being adopted. DataM Intelligence

2. Transition from prototyping to end-use manufacturing

3D printing is evolving from concept models to actual end-use components, especially in sectors like aerospace, medical devices, and automotive. This shift requires more reliable polymers. DataM Intelligence

3. Collaboration between material and printer OEMs

Hardware manufacturers and polymer developers are forming partnerships to co-develop materials and printer systems that can accommodate high-temperature polymers. For instance, Roboze, an extrusion printer OEM, worked with SABIC to create a high-performance thermoplastic filament (EXTEM AMHH811F). DataM Intelligence

4. Technological advancement and R&D investments

The polymer sector is innovating, focusing on new formulations, composites, reinforcement strategies, better processing control, and improved printability—all key to advancing 3D printing technology. DataM Intelligence

5. Regional industrialization and manufacturing policies

Government initiatives to promote additive manufacturing, local production, and Industry 4.0 in areas like Asia Pacific, Europe, and North America are boosting demand for advanced materials.

6. Growing demand in high-value sectors

Industries like healthcare, aerospace, and defense require advanced polymers, providing strong momentum for the market.

At the same time, there are challenges such as limited availability of suitable polymer chemistries at scale, printer hardware incompatibility or limitations, high costs for large-volume prints, warping and shrinkage issues, and intellectual property or licensing obstacles. DataM Intelligence

Key Players & Competitive Landscape

The polymers for 3D printing market is somewhat fragmented, featuring both large global companies and specialized material firms competing for market share. DataM Intelligence According to the report, some notable companies include:

• BASF SE

• Innofil3D BV

• ELIX Polymers

• Carbon Inc.

• Arkema Group

• Evonik

• Stratasys Ltd.

• EnvisionTEC Inc.

• 3D Systems Corporation

• Royal DSM N.V. DataM Intelligence

These companies use various strategies to remain competitive:

• New product launches and material innovations. For example, ELIX Polymers has developed a new ABS material optimized for 3D printing, targeting reduced warping, better dimensional accuracy, and improved mechanical performance. DataM Intelligence

• Mergers, acquisitions, and strategic partnerships to expand their polymer portfolio, integrate vertically, or access new markets or technologies. DataM Intelligence

• Collaborative R&D with research institutions, universities, or printing OEMs to develop materials suited for next-generation printers.

• Geographic expansion and localization. Some companies are scaling operations in emerging regions like Asia Pacific and Latin America to meet local demand, lower logistics costs, and customize materials for regional needs.

As the materials aspect is crucial to the value chain, companies that can better match polymer properties with printer capabilities and user specifications will likely gain a stronger position.

Recent Developments (2025)

While the public summary of the report is dated January 2024, it claims to cover recent developments, mergers, acquisitions, new product launches, and growth strategies in its complete version. DataM Intelligence Here are some potential recent trends that a 2025 update might feature:

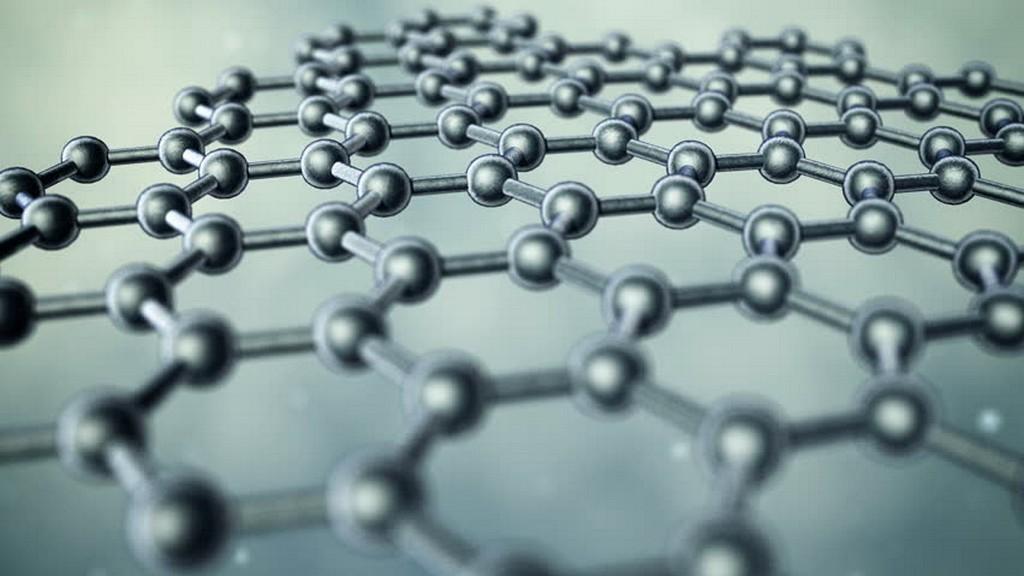

• New filament or composite product launches. Various material firms may have introduced next-generation high-temperature polymers, carbon/graphene-reinforced filaments, or enhanced photopolymers with improved mechanical and thermal properties.

• Strategic collaborations. Partnerships may continue to emerge between polymer producers and printer OEMs to validate new materials and co-engineer printer modules, such as high-temperature nozzle systems and heated chambers.

• Additive manufacturing certifications and standards. In 2025, there could be a heightened focus on certifying polymer 3D printed parts, particularly in aerospace and medical applications, pushing material suppliers to meet stricter industry standards.

• Scale-up of industrial deployment. More companies may adopt polymer 3D printing for small-batch production, spare parts, and specialized components, putting pressure on supply chains for advanced polymers.

• Regional policy support. Governments in Asia, Europe, and North America may introduce new subsidies, AM roadmaps, or funding initiatives to promote local polymer 3D printing ecosystems, increasing local demand and materials development.

If your press release is being published in mid to late 2025, you may want to include specific data points from local or industry news (e.g., “in Q1 2025, Company X launched a carbon-fiber PEEK filament at a lower cost”) to reinforce its relevance.

📌 Buy Now & Unlock 360° Market Intelligence: https://www.datamintelligence.com/buy-now-page?report=polymers-for-3d-printing-market

Benefits of the Report (Why It Matters)

Investing in or subscribing to the full Polymers for 3D Printing report from DataM Intelligence offers numerous benefits for different stakeholders:

1. Granular Market Insights & Forecasts

You gain access to detailed segmentation, enabling precise valuation, pricing strategy, gap analysis, and roadmap planning. DataM Intelligence

2. Competitive Intelligence

The report includes profiles of major polymer and 3D printing companies, detailing their product offerings, strategies, recent partnerships, and market positioning to help you benchmark and anticipate movements in the market. DataM Intelligence

3. Opportunity Identification

The report outlines unmet needs, regional demand areas, technology gaps, co-development opportunities, and areas for next-gen polymers, enabling effective strategy formulation. DataM Intelligence

4. Data Export / Excel Sheets

The purchase comes with an Excel dataset containing thousands of data points across various segments, useful for modeling, internal financials, presentations, or integrations. DataM Intelligence

5. Future Roadmap & Trend Tracking

Qualitative interviews, trend analysis, market drivers and restraints, and outlook chapters provide direction and insight for R&D and business strategy. DataM Intelligence

6. Support for Strategic Decision-Making

Whether you are a polymer supplier, printer OEM, investor, end-user, or research institution, these insights help you decide where to invest, expand, or focus innovation.

Given the rapid evolution of additive manufacturing, having a forward-looking and data-driven resource is essential to maintaining competitiveness in the polymers to printer value chain.

📌 Request for 2 Days FREE Trial Access: https://www.datamintelligence.com/reports-subscription

☛ Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

Conclusion & Call to Action

The polymers for 3D printing market is at a crucial turning point. What began as a supplement to prototyping is now evolving into a space where materials define possibilities. The shift toward high-performance thermoplastics, composite resins, and specialized polymer systems is accelerating. However, success relies on close alignment between material innovation, printer hardware, regulatory compliance, and user needs.