Market Overview:

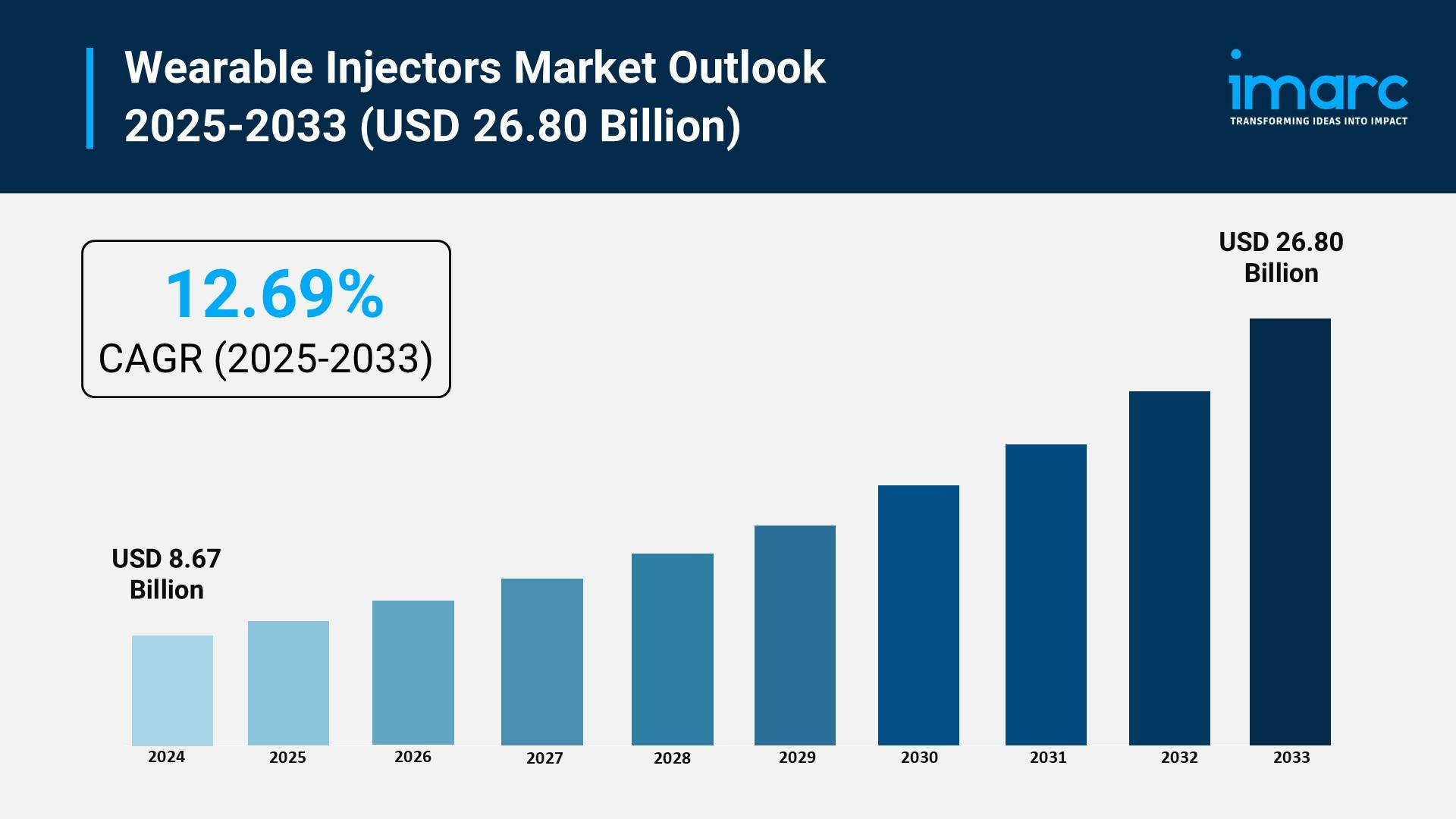

According to IMARC Group's latest research publication, "Wearable Injectors Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global wearable injectors market size reached USD 8.67 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 26.80 Billion by 2033, exhibiting a growth rate (CAGR) of 12.69% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

How AI is Reshaping the Future of Wearable Injectors Market

- AI enhances drug delivery precision in wearable injectors by optimizing dosing algorithms, reducing medication errors by 15% through intelligent flow control and real-time monitoring systems.

- Digital health integration with AI-powered platforms enables remote patient monitoring, with 80% of connected wearable injectors now incorporating Bluetooth and mobile app connectivity for therapy tracking.

- Machine learning algorithms facilitate personalized drug delivery by analyzing patient data patterns, with AI-assisted analytics representing the next frontier in connected drug delivery systems.

- AI drives development of hybrid closed-loop systems (artificial pancreas devices) that combine continuous glucose monitoring with automated insulin delivery, improving diabetes management for millions.

- Smart injectors leverage AI for dose prediction and bioavailability optimization, accelerating device development and improving clinical success rates while ensuring HIPAA and GDPR compliance.

- AI-powered diagnostics in drug delivery systems enable real-time monitoring, with digital diagnostic devices supporting disease screening and treatment monitoring across multiple therapeutic areas.

Download a sample PDF of this report: https://www.imarcgroup.com/wearable-injectors-market/requestsample

Key Trends in the Wearable Injectors Market

- Surge in Home-Based Healthcare Adoption: The transition toward home-based healthcare is accelerating wearable injector adoption, with home care accounting for 42.7% market share in 2024. Patients value self-administration convenience that eliminates hospital visits while maintaining treatment efficacy. The global home healthcare market is projected to reach USD 816.4 Billion by 2033, driving demand for at-home drug delivery solutions.

- Rise of Large-Volume Biologics Delivery: The expanding pipeline of biologics requiring subcutaneous delivery in high volumes (1-50 mL) is driving innovation. Wearable injectors address challenges of traditional delivery methods by enabling automated, patient-administered delivery of high-viscosity drugs. LTS LOHMANN launched large-volume injectors supporting delivery ranges from 1 mL to over 50 mL for complex biologics.

- Connected Device Revolution: Integration of wireless connectivity features (Bluetooth, NFC) is transforming wearable injectors into smart devices. Real-time monitoring of drug delivery parameters, patient compliance tracking, and seamless integration with healthcare provider systems enhance patient engagement. Connected wearable injectors dominate due to their utility in chronic disease management.

- Spring-Based Technology Leadership: Spring-based technology leads with 35.8% market share in 2024, valued for reliability, simplicity, and cost-effectiveness. These devices utilize mechanical spring mechanisms for controlled drug delivery, making them ideal for large-volume biologics and viscous drugs in chronic conditions like cancer and diabetes, while requiring minimal intervention for home self-administration.

- Oncology Applications Expansion: Oncology leads applications with 29.5% market share in 2024, driven by increasing cancer prevalence. With approximately 2,041,910 new cancer cases and 618,120 cancer deaths projected in the United States for 2025, wearable injectors offer convenient, controlled delivery enabling patients to receive treatments at home, improving quality of life and adherence.

Growth Factors in the Wearable Injectors Market

- Chronic Disease Epidemic: Rising incidence of diabetes, cancer, and autoimmune conditions drives demand. The International Diabetes Federation reveals 590 million people globally have diabetes in 2025, projected to reach 853 million by 2050. These conditions require long-term management and repeated drug administration, positioning wearable injectors as patient-friendly solutions.

- Technological Advancements in Drug Delivery: Ongoing innovations in microelectronics, intelligent sensors, and wireless connectivity are advancing device capability. Integration of feedback systems, miniaturization, and ergonomic design make injectors comfortable for extended wear. Next-generation devices like West's SmartDose and Amgen's Neulasta Onpro utilize motor-driven or spring-based mechanisms for enhanced precision.

- Favorable Regulatory Environment: Regulatory bodies like FDA and EMA are establishing clear definitions for combination drug-device products, streamlining development and approval processes. In July 2025, BD announced the inaugural pharma-sponsored clinical trial for BD Libertas™ Wearable Injector, with 100% of participants indicating willingness to use if prescribed.

- Patient-Centric Healthcare Models: Healthcare systems emphasize treatments that improve quality of life and enhance compliance. Wearable injectors enable tailored, adaptive, and minimally invasive drug delivery. Integration with mobile apps and cloud platforms enables reminders, therapy monitoring, and data sharing with medical professionals, fostering greater patient engagement.

- Biologics Market Expansion: The pharmaceutical industry's growing focus on large-molecule biologics propels market growth. Biologics often require high-volume subcutaneous delivery challenging with conventional devices. February 2025 saw FDA approval of ONAPGO as the first wearable injector-based subcutaneous apomorphine infusion device for advanced Parkinson's disease.

Leading Companies Operating in the Global Wearable Injectors Industry:

- Becton Dickinson and Company

- CeQur SA

- Debiotech SA

- Dexcom Inc.

- Enable Injections Inc.

- Gerresheimer AG

- Insulet Corporation

- Tandem Diabetes Care Inc.

- West Pharmaceutical Services Inc.

- Ypsomed AG

Wearable Injectors Market Report Segmentation:

Breakup By Type:

- On-body

- Off-body

On-body accounts for the majority of shares due to convenience, ease of use, and hands-free solution for medication delivery that enables patients to self-administer medications without interrupting daily activities.

Breakup By Technology:

- Spring-based

- Motor-driven

- Rotary Pump

- Expanding Battery

- Others

Spring-based leads the market with 35.8% share in 2024, driven by simplicity, reliability, and cost-effectiveness using mechanical mechanisms independent of complex electronics.

Breakup By Application:

- Oncology

- Infectious Diseases

- Cardiovascular Diseases

- Autoimmune Diseases

- Others

Oncology dominates with 29.5% market share in 2024, driven by increasing cancer cases requiring frequent chemotherapy administration and the need for comfortable, convenient home-based treatment options.

Breakup By End Use:

- Hospitals and Clinics

- Home Care

- Others

Home Care leads with 42.7% market share in 2024, driven by growing trend toward patient-centric healthcare delivery and increasing demand for convenient, cost-effective treatment approaches enabling self-administration at home.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America enjoys the leading position with 34.2% market share in 2024, owing to advanced healthcare infrastructure, robust reimbursement framework, supportive regulatory environment, and high uptake of innovative medical technologies.

Recent News and Developments in Wearable Injectors Market

- July 2025: BD (Becton, Dickinson and Company) revealed the inaugural pharma-sponsored clinical trial for a combination product utilizing the BD Libertas™ Wearable Injector for subcutaneous administration of complex biologics, with 100% of participants indicating they would probably use the device if prescribed.

- June 2025: CeQur achieved a milestone by replacing 10 Million mealtime insulin injections with its Simplicity wearable injectors, underscoring the device's role in simplifying diabetes care since its pilot commercial launch in 2021, improving patient compliance and convenience.

- April 2025: Medtronic received US FDA approval for the Simplera Sync sensor for use with the MiniMed 780G system, offering more flexibility for users of the company's advanced insulin delivery system, featuring Meal Detection technology.

- April 2025: INCOG BioPharma Services revealed plans for strategic expansion projects in 2025, involving physical growth of its Fishers facilities to offer device assembly capacity for autoinjectors, pens, wearable injectors, and syringe accessories.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201-971-6302