Market Overview:

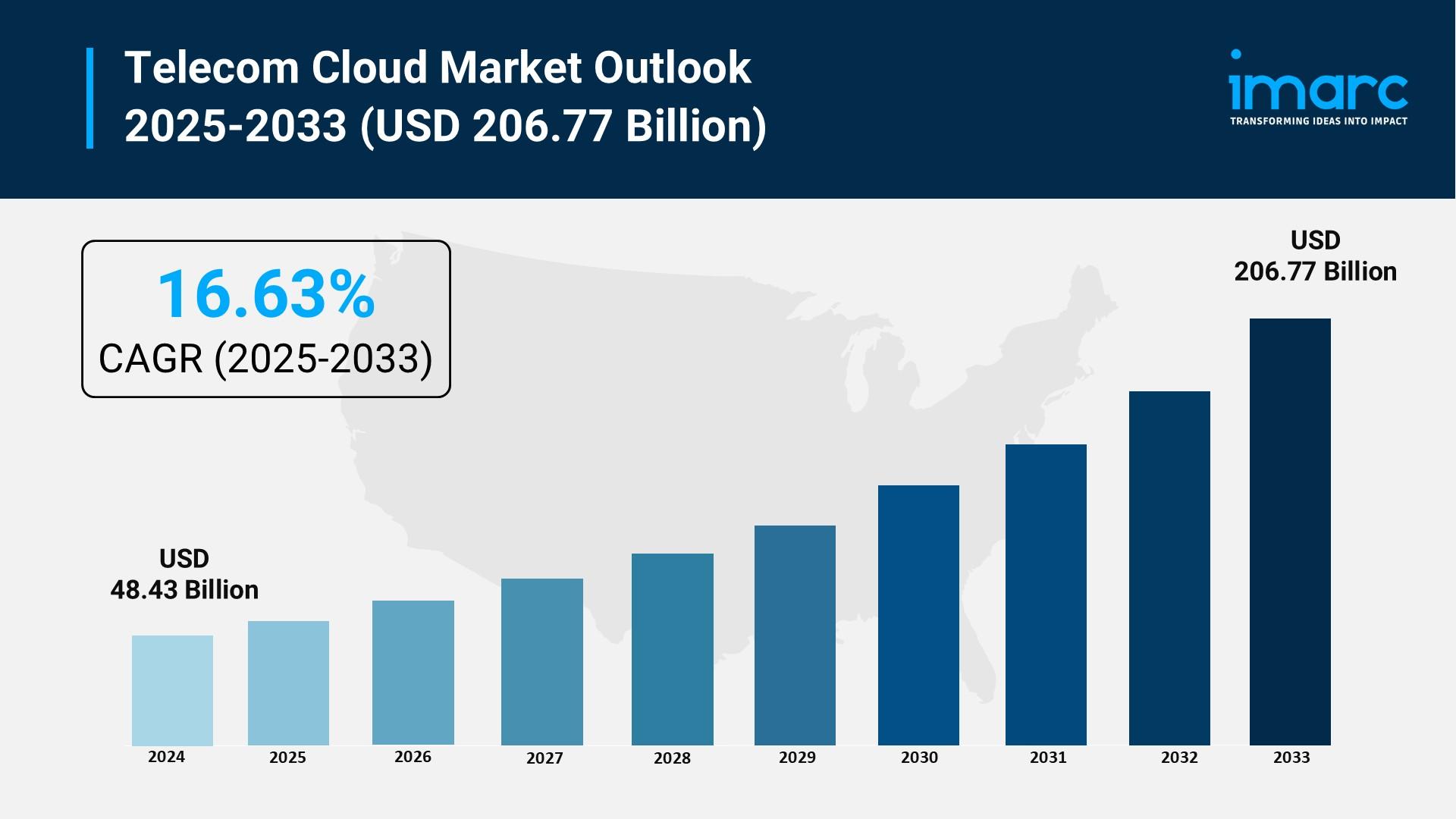

The Telecom Cloud Market is experiencing significant expansion, driven by Increasing 5G Integration, Rising Adoption of Hybrid Cloud, and AI and Automation. According to IMARC Group's latest research publication, "Telecom Cloud Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global telecom cloud market size was valued at USD 48.43 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 206.77 Billion by 2033, exhibiting a CAGR of 16.63% from 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/telecom-cloud-market/requestsample

Our Report Includes:

- Market Dynamics

- Market Trends and Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Telecom Cloud Market Industry:

- Increasing 5G Integration

The telecom cloud industry is poised for significant expansion, fueled by swift 5G implementation. As reported by 5G Americas and Omdia, 5G is expanding four times quicker than 4G LTE, with a global average of 1.5 wireless connections per individual anticipated by the end of 2024 and an estimated 8.3 billion 5G connections by 2029. The integration of 5G with cloud infrastructure is improving network efficiency, reducing latency, and facilitating scalable, adaptable deployment. Telecom companies utilize cloud platforms to effectively manage 5G networks and enable real-time services. The worldwide transition towards 5G, which requires highly adaptable and scalable network infrastructures, is impelling the market growth. Telecom cloud facilitates virtualized network functions that can accommodate the high speed, low latency, and extensive device connectivity essential for 5G. This eliminates the necessity for expensive physical enhancements. In October 2024, Siemens partnered with LS telcom to provide private 5G wireless solutions for industrial applications, ensuring complete deployment and support. The cloud manages enormous 5G data volumes, enabling applications like autonomous systems and intelligent urban areas. Increasing investments in telecom cloud infrastructure and services demonstrate the growing need for quicker, more flexible connectivity.

- Rising Adoption of Hybrid Cloud

Telecom companies are progressively embracing hybrid cloud strategies to utilize the benefits of both private and public cloud environments. This strategy provides adaptability by enabling sensitive information and essential applications to be managed in private clouds, while employing public clouds for scalable and economical handling of less sensitive tasks. An industry report indicates that 39% of organizations currently employ a hybrid cloud strategy, an increase from 36% the previous year, underscoring its rising attractiveness for scalability, service integration, and business continuity. Hybrid cloud solutions assist telecom companies in addressing increasing needs for data protection, adherence to regulations, and effective workload allocation. In addition, telecom operators can decrease capital and operational expenditures by substituting traditional hardware with virtualized network functions (VNFs) operating on standard servers. Cloud-native architectures enable automated scaling and provisioning, minimizing the requirement for manual oversight or surplus infrastructure. In October 2024, Bouygues Telecom Entreprises and OVHcloud joined forces to deliver hybrid cloud solutions for midsize companies, aiding in cloud migration and enhancing IT security. Through the integration of hybrid models, telecom companies can enhance operational efficiency, safeguard infrastructure, and provide tailored services that match the changing requirements of enterprises.

- AI and Automation

Telecom companies are employing artificial intelligence (AI) for predictive maintenance, client assistance, and network enhancement. These tools need significant computing capacity and storage, which cloud platforms can provide. It allows operators to execute AI models nearer to data sources, enhancing response times. AI and automation are major factors supporting the telecom cloud industry growth. A study of the industry revealed that 59% of executives at communications service providers (CSP) utilize conventional AI for detecting security threats in networks, whereas generative AI is primarily used for spam management (33%) and fraud management (31%). AI enhances network optimization by forecasting traffic trends, dynamically reallocating resources, and improving bandwidth utilization. Predictive maintenance enables operators to identify possible failures in advance, decreasing downtime and lowering repair expenses. Additionally, AI-powered cybersecurity enhances protection against emerging threats by identifying and reducing risks instantaneously, guaranteeing safe network functions. In February 2024, Lenovo revealed edge AI partnerships with prominent telecom companies. The projects focus on providing AI tasks for clients, such as smart city solutions and sustainability initiatives. These partnerships represent an important advancement in positioning AI at the center of telecommunications and cloud technology.

Key Trends in the Telecom Cloud Market:

- Expansion of Open RAN and Vendor Disaggregation

A major shift is occurring as operators move away from proprietary, single-vendor hardware stacks in favor of Open Radio Access Network (Open RAN) solutions. This trend involves the "cloudification" of the RAN, allowing software to run on commercial off-the-shelf (COTS) hardware. By disaggregating hardware and software, telecom providers are gaining greater flexibility to choose "best-of-breed" components from various vendors, which fosters innovation and drives down equipment costs through increased market competition.

- Rise of Satellite-Cloud Convergence (NTN)

The integration of Non-Terrestrial Networks (NTNs) with terrestrial telecom clouds is emerging as a critical trend for 2026. Major operators are partnering with low-earth orbit (LEO) satellite providers to extend cloud connectivity to remote and underserved regions. This hybrid architecture allows for seamless roaming between satellite and cellular networks, enabling ubiquitous IoT coverage and ensuring business continuity for global enterprises that require constant connectivity across vast geographical footprints.

- Strategic Focus on Sovereign and Green Cloud Solutions

With tightening data residency regulations and rising energy costs, the industry is seeing a dual focus on digital sovereignty and environmental sustainability. Telcos are increasingly deploying "sovereign clouds" to ensure that sensitive subscriber data remains within national borders, complying with localized legal frameworks. Simultaneously, there is a push toward "green" telecom clouds, where operators utilize AI-driven power management and liquid-cooling technologies in data centers to minimize their carbon footprint and meet global ESG (Environmental, Social, and Governance) mandates.

Leading Companies Operating in the Global Telecom Cloud Market Industry:

- Amazon Web Services Inc. (Amazon.com Inc.)

- BT Group plc

- China Telecom Corporation Limited

- Dell Technologies Inc.

- Deutsche Telekom AG

- Google LLC

- International Business Machines Corporation

- Microsoft Corporation

- Nippon Telegraph and Telephone Corporation

- Oracle Corporation

- Singapore Telecommunications Limited

- Telefonaktiebolaget LM Ericsson

- Telstra Corporation Limited

- Telus Corporation

- Verizon Communications Inc.

Telecom Cloud Market Report Segmentation:

Breakup by Type:

- Public Cloud

- Private Cloud

- Hybrid Cloud

Public cloud dominates the market owing to its cost-effectiveness, adaptability, and capacity to offer on-demand resources without necessitating significant capital expenditure. Telecom providers are increasingly depending on public cloud service to handle varying workloads, speed up time-to-market, and simplify infrastructure management.

Breakup by Computing Services:

- SaaS

- IaaS

- PaaS

SaaS exhibited a clear dominance in the market in 2024, holding 56.2% of the market share. The dominance of the segment is because of its straightforward deployment, scalability, and capability to provide applications online without complicated infrastructure needs.

Breakup by Application:

- Computing

- Data Storage

- Achieving

- Enterprise Application

- Others

Computing exhibited a clear dominance in the market attributed to the increasing demand for effective processing capabilities, scalable infrastructure, and assistance for virtualization throughout telecom networks.

Breakup by End User:

- BFSI

- Retail

- Manufacturing

- Transportation and Distribution

- Healthcare

- Government

- Media and Entertainment

- Others

BFSI exhibited a clear dominance in the market due to its persistent need for secure, scalable, and high-performance communication systems. The industry depends significantly on continuous data access, instant communication, and smooth connectivity to facilitate everyday activities, client interaction, and adherence to regulations.

Breakup by Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America dominated the global market in 2024, accounting for 38.1% of the market share, due to its robust digital infrastructure, swift 5G deployment, and extensive cloud integration in the telecom industry. The region benefits from having prominent cloud service providers and telecom companies that invest significantly in updating and automating networks.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201-971-6302