When applying for a mortgage to buy a house in Toronto, the information you provide on the application simply helps lenders start the loan process. Beyond these basic details, lenders dig deeper, evaluating other aspects and crunching various numbers. This verification process ensures your application details are correct and that you can handle the mortgage payments.

Among all the crucial details lenders review, your debt-to-income (DTI) ratio is a key factor that can swing your mortgage approval either way. Today, we’ll explore key details about this DTI so you can dodge mortgage rejection and unnecessary financial stress. Let’s begin!

Ideal Debt-to-Income (DTI) Ratios to Qualify for a Mortgage in Toronto

The DTI is a measure of how much of your monthly income is allocated toward paying off debts, such as credit cards, car loans, and other outstanding debts. DTI also calculates your potential mortgage payments on the MLS listing in Toronto you’re buying. Lenders use this DTI ratio to decide whether you can afford the house without stretching your budget too thin.

A high ratio signals to lenders that you might struggle to make payments, which can hurt your approval odds. In some cases, because of a high DTI, you might not qualify for a mortgage at all. On the other hand, the lower your DTI, the higher your chances of getting approved.

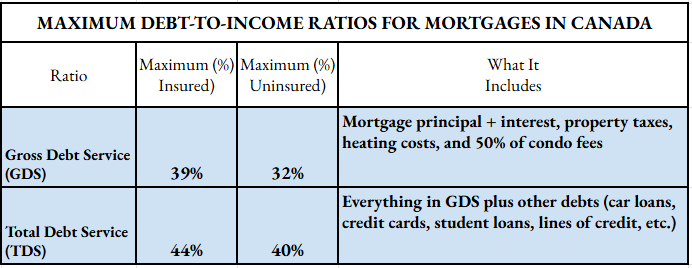

Typically, the “ideal debt-to-income ratios” depend on your lender and whether your mortgage is insured. For gross debt service ratios, lenders usually accept up to 32% for an uninsured mortgage. With an insured mortgage, they usually allow up to 39%. For total debt service ratios, the limits are slightly higher. The safe zone for this ratio is 40% for an uninsured mortgage and 44% for an insured one.

How Lenders Assess Your Debt-to-Income Ratio

There are two main ratios lenders use: Gross Debt Service (GDS) and Total Debt Service (TDS). GDS measures the portion of your gross monthly income that goes toward the ownership expenses of the MLS listing in Toronto. These expenses include your mortgage payments, property taxes, and heating (and condo fees if you’re buying a condo). TDS goes further by including all your monthly debts, including the home mortgage.

Now, let’s break down how lenders calculate the DTI ratios with an example. Suppose you’re considering an $800,000 house in Toronto. We calculated monthly mortgage payments for this house using an online mortgage calculator in Canada.

- For an insured mortgage with a minimum down payment, a 4% interest rate, and 30-year amortisation, your monthly payment would be $3,699.

- For an uninsured mortgage with a 20% down payment, 4% interest, and 30-year amortization, the payment drops to $3,055.

We also estimated property taxes using the WOWA Property Tax Calculator. For this home, the property tax would be around $476.80 per month. We assumed monthly heating costs of $200 and a gross monthly income of $14,000.

➔ STEP 1: Calculate GDS

GDS FORMULA = (Mortgage + Property Taxes + Heating)/ Gross Monthly Income X 100

Add your mortgage, taxes, and heating:

- Insured mortgage: $3,699 + $476.80 + $200 = $4,375.80

➡️ GDS = $4,375.80/$14,000 X 100 = 31.3%

- Uninsured mortgage: $3,055 + $476.80 + $200 = $3,731.80

➡️ GDS = $3,731.80/$14,000 X 100 = 26.7%

➔ STEP 2: Calculate TDS

TDS FORMULA = (Housing Costs + Other Monthly Debts)/Gross Monthly Income X 100

Include other monthly debts (assumed $1,200):

- Insured mortgage: $4,375.80 + $1,200 = $5,575

➡️TDS = $5,575/$14,000 X 100 = 39.8%

- Uninsured mortgage: $3,731.80 + $1,200 = $4,931.80

➡️ TDS = $4,931.80/$14,000 X 100 = 35.2%

The Mortgage Stress Test Is Also Something to Consider

When applying for a mortgage to buy a house, there’s one important hurdle you can’t skip: the mortgage stress test. This regulatory measure is in place to protect both you and the lender from financial strain. The stress test checks if you can still afford your payments at a higher rate, not just the one on your contract. Every borrower working with a federally regulated lender (big banks or federal credit unions) must pass this test.

The stress test uses the higher of two rates:

- The Bank of Canada’s posted 5-year benchmark rate, or

- Your contract mortgage rate plus 2%

For example, let’s say your mortgage rate is 4%. Under the stress test, your qualifying rate jumps to 6%. However, if the Bank of Canada’s benchmark rate is higher than 6%, then that benchmark becomes the rate used in the calculation.

How the Stress Test Affects Your Debt-to-Income Ratio

When lenders calculate your debt-to-income (DTI) ratios, they assume the higher stress test rate, not your lower qualifying rate. This raises your monthly mortgage in both GDS and TDS calculations. Because the mortgage portion of your DTI rises under the stress test, your GDS and TDS ratios look higher. As a result, you might qualify for a smaller mortgage than if lenders only considered your actual interest rate.

Can You Still Qualify for a Mortgage Even With a High Debt-to-Income Ratio?

Fortunately, having a high debt-to-income ratio doesn’t automatically shut the door on homeownership. Even if your DTI ratio is higher than lenders prefer, there are strategies to show them you can handle a mortgage. Let’s break down the options you can explore.

1. Boost Your Down Payment to Reduce Risk

A larger down payment reduces the total mortgage amount needed to buy the house. This strategy can lower your monthly payments and make your debt-to-income ratio look more ideal to lenders. Even adding 5-10% extra can signal that you’re financially responsible and serious about homeownership.

2. Reduce Existing Debts to Free Up Your Income

Lenders look closely at your monthly obligations, so every dollar you pay off counts. Start by paying down high-interest debts and consider consolidating multiple debts into one lower-interest loan. Additionally, avoid taking on new debt while your mortgage application is in process.

3. Choose a House in Toronto That Costs Less

Sometimes, the easiest way to qualify is to scale back on the price of the home you’re buying. Opting for a slightly expensive property reduces the size of the mortgage and the monthly payments, making your DTI ratio more favourable.

4. Bring in a Co-Signer

If your DTI is higher than lenders prefer, consider adding a co-signer or co-borrower to the application. In this case, the lender will consider the co-borrower's income and credit history alongside yours, which can help offset your high DTI.

5. Explore Alternative or Private Lenders

If traditional banks are hesitant, some private or alternative lenders may offer more flexible terms. Private lenders often look beyond standard DTI limits, focusing on your overall financial picture.

6. Show Off Strong Credit History

A strong credit profile reassures lenders that you are responsible and capable of managing a mortgage. To strengthen your mortgage application, you must aim for a credit score of 700 or higher. Beyond the number, your credit history should show consistent, on-time payments, low credit card balances, and no recent defaults or collections.

Need More Clarity On DTI Before Buying a Home?

Before you apply for a mortgage, make it a priority to connect with a mortgage broker. Your debt-to-income ratio plays a huge role in whether lenders approve your mortgage, so understanding it is essential. Beyond asking the basic questions to the mortgage broker, dive deep into your debt-to-income ratio and clear any doubt you might have. This way, you can avoid surprises later and approach your mortgage application fully prepared.