Vapor Recovery Units Market Projected to Reach USD 1.36 Billion by 2029, Driven by VOC Regulations and Oil & Gas Expansion

Market Size

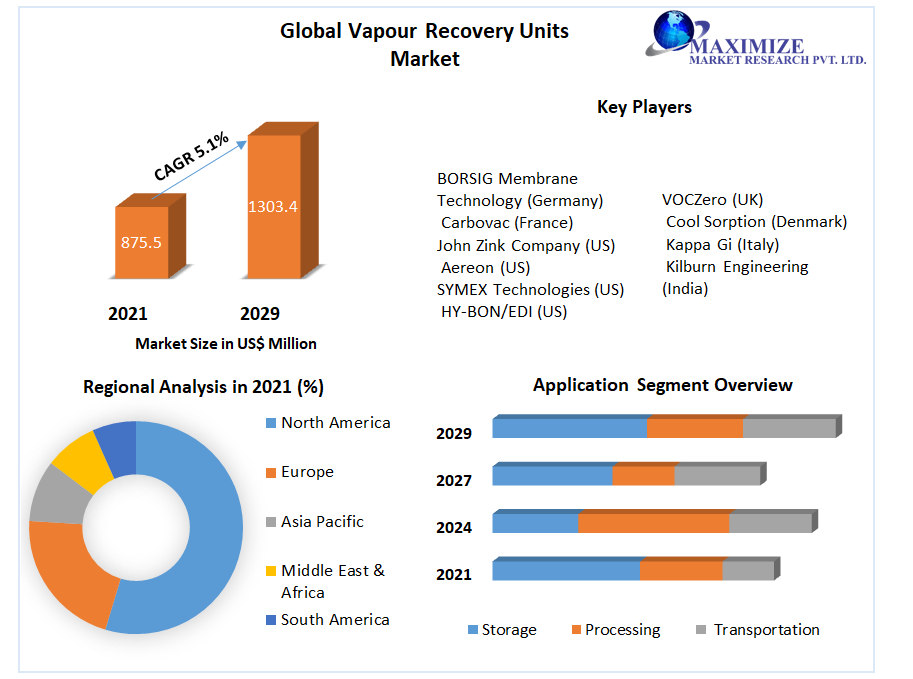

- 2023 market estimation: ~USD 820 million

- 2024 forecast: ~USD 867 million

- 2032 outlook: ~USD 1.36 billion with a CAGR of ~5.8% (2024–2032)

Alternative forecast models estimate growth reaching USD 1.0 billion by 2027 (CAGR ~3.9%) and up to USD 2.33 billion by 2035 at ~5.3% CAGR.

Overview

Vapor Recovery Units (VRUs) are specialized systems designed to capture and process volatile organic compounds (VOCs) released from storage tanks, loading stations, and transit operations in industries such as oil & gas, petrochemicals, and chemicals. By recovering vapors through adsorption, condensation, membrane separation, or absorption mechanisms, VRUs mitigate environmental pollution, capture economic value, and support compliance with global emission standards.

To Know More About This Report Request A Free Sample Copy https://www.maximizemarketresearch.com/request-sample/4182/

Market Estimation & Definition

The VRU market encompasses:

- Technology Types: Condensation-based, Adsorption-based, Membrane separation, Absorption, Rotary ejector systems

- Applications: Processing facilities, storage tanks, and transportation (truck, rail, marine loading operations)

- End‑Use Industries: Oil & Gas (largest share), Chemical & Petrochemical, Pharmaceuticals, food & others

- Geographic Regions: North America, Europe, Asia‑Pacific, Latin America, Middle East & Africa

Growth Drivers & Opportunity

- Strict Global VOC Emission Regulations

Regulatory mandates by agencies such as EPA (USA) and EU counterparts require high-efficiency vapor control, spurring VRU adoption at terminals and refineries. - Expansion in Oil & Gas and Chemical Refineries

Growth in downstream activities—especially tank farms and transportation terminals—increases VRU deployment to prevent vapor loss. - Transportation-Linked Applications Leading Revenues

Terminal activities involving truck, rail, and marine loading represent the largest application segment for VRUs due to vapor emissions during hydrocarbon transfer. - Technological Innovation

Newer compact and modular VRUs utilizing membrane separation or hybrid condensation-membrane processes offer lower energy use and easier retrofitting. - Rapid Industrialization in Asia-Pacific

Countries such as China, India, and ASEAN nations are investing heavily in petroleum infrastructures while enforcing stricter environmental norms, creating robust market demand.

Segmentation Analysis

- By Application

- Transportation Loading: Largest segment by revenue due to high vapors during fueling and terminal loading

- Storage Tanks: Fastest-growing segment, driven by compliance needs at tank farms

- Processing: Moderate growth from refineries and chemical units

- By End‑Use Industry

- Oil & Gas: Dominates the market with highest adoption across upstream, midstream, and downstream

- Chemical & Petrochemical: Emerging fast due to VOC-rich processes

- Other Industries: Select growth in pharmaceuticals, food & beverage secondary applications

- By Technology

- Adsorption VRUs: Widely installed for reliability in varied climates

- Condensation VRUs: Effective in cold climates and cryogenic operations

- Membrane Splitting VRUs: Compact and efficient—gaining appeal for retrofit across terminals

Major Manufacturers

Key global players in the vapor recovery units market include:

- John Zink Hamworthy Combustion

- PSG Dover / Aareon

- Cimarron Energy, Inc.

- Zeeco, Inc.

- Petrogas Systems

- VOCZero

- Hy‑Bon/EDI

- Kappa GI

- Cool Sorption A/S

These companies lead in modular VRU designs, digital monitoring capabilities, and compliance‑driven performance.

Regional Analysis

North America

- Largest region (≈40–45% share in 2024)

- Strong demand driven by EPA regulations and high-volume oil & gas activities in the US and Canada

Europe

- Significant market share due to strict environmental policies in the EU, Germany, UK, and France

- Accelerated adoption at petrochemical and fuel distribution facilities

Asia‑Pacific

- Fastest growing region with ~6–8% CAGR

- Growth propelled by industrial expansion, growing refineries, and government mandates in India, China, Japan, and Southeast Asia

Latin America & Middle East/Africa

- Moderate growth tied to infrastructure build-out in oil-producing countries and chemical plant expansion

COVID‑19 Impact Analysis

The COVID-19 pandemic caused short-term disruptions in industrial activity and capital projects in 2020. Recovery from 2021 onward was supported by renewed terminal build-outs and regulated emission control projects. Investment in remote monitoring, modular VRUs, and turnkey services surged to compensate for travel and access restrictions in 2021–2023.

Competitive Analysis (Commutator Analysis)

- Technology Differentiation: Leading vendors offer modular skid-mounted, hybrid tech (combined condensation + membrane), and digital twins for remote emission monitoring.

- Compliance Certification: Global standards compliance (e.g., EPA Method 21/25, EU directives) is key to client trust and regulatory acceptance.

- Aftermarket Services & Integration: Vendors combining installation, maintenance service contracts, and VRU analytics software enjoy stronger retention.

- Local vs Global Reach: Companies with global footprint but localization capability (e.g. Asia‑based engineering services) hold competitive advantage in emerging markets.

- Barriers to Entry: High capital expenditure, specialized engineering, and safety protocols limit entry largely to established specialist players.

Key Questions Answered

- What is the current market size and forecast?

– USD 820 M in 2023; projected to reach USD 1.36 B by 2032 (~5.8% CAGR). - Which application is the largest, and which grows fastest?

– Transportation loading leads revenue; storage application shows fastest growth. - Which end-use industry dominates?

– Oil & Gas represents the majority share; chemical & petrochemical is increasingly important. - Which region leads, and which grows fastest?

– North America leads by volume; Asia‑Pacific exhibits strongest growth momentum. - Who are the market’s key players?

– John Zink, Aareon (PSG Dover), Cimarron Energy, Zeeco, Petrogas, Hy‑Bon/EDI, Cool Sorption, VOCZero among leading suppliers.

Conclusion

The global vapor recovery units market is on a robust upward trajectory, with value expected to grow from USD 820 million in 2023 to USD 1.36 billion by 2032. Driven by stringent VOC emission laws, expanding oil & gas infrastructure, and technological innovation in compact and efficient recovery systems, VRUs have become indispensable in refinery, terminal, and transportation environments.

Providers offering technology leadership, regulatory compliance, digital integration, and modular installation are best positioned to capitalize on this market. As sustainability targets tighten and emission accountability rises globally, vapor recovery units will remain a vital tool in achieving environmental and operational excellence across industries.

About Maximize Market Research:

Maximize Market Research is a global market research and consulting company specializing in data-driven insights and strategic analysis. With a team of experienced analysts and industry experts, the company provides comprehensive reports across various sectors, aiding businesses in making informed decisions and achieving sustainable growth.

Contact Us

Maximize Market Research Pvt. Ltd.

2nd Floor, Navale IT Park, Phase 3

Pune-Bangalore Highway, Narhe

Pune, Maharashtra 411041, India

📞 +91 96073 65656

✉️ sales@maximizemarketresearch.com