We know, this is one of those situations you’d rather avoid thinking about. However, with household debt piling up, wages barely growing, and unemployment creeping up, the chance of falling behind on mortgage payments is now a real concern for many. In fact, Canada’s mortgage delinquency rate - the number of homeowners behind on payments - has increased to 0.22% as of early 2025. So, if you’re also falling behind on your mortgage, remember that many others are in the same situation.

Generally, there are several paths you can take if you’re late on mortgage payments. But is selling your Welland house an option? Let’s explore this in detail below!

The Consequences of Skipping Mortgage Payments

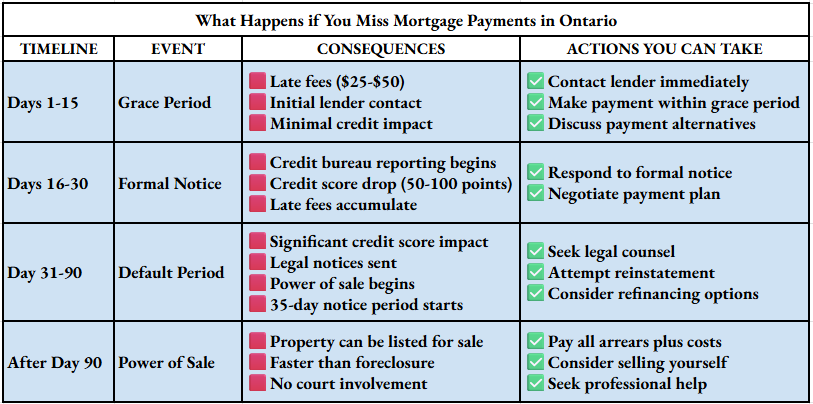

Even a single payment can trigger a series of actions from your lender. Here’s a clear breakdown of what happens if you miss mortgage payments -

1. Late Fees Can Start Adding Up

Most lenders give homeowners a 15-day grace period after the payment due date for Welland houses for sale. During this time, you can make your payment without heavy penalties. However, the lender might charge you a late fee. These fees usually range from $20 to $50, depending on your lender.

Late fees aren’t just one-time charges - they continue to accumulate until you bring your mortgage current. Over time, these fees increase the total amount you owe, known as arrears.

Arrears include:

- Missed monthly payments

- Any late fees or penalties

- Interest accrued on overdue amounts

Let’s understand how arrears can accumulate with an example. Suppose your mortgage balance is $800,000, your amortisation period is 25 years, and your mortgage rate is 4%. According to a mortgage calculator, your monthly payment will be $4,090.

In the table below, you can see how missing payments increase the total arrears on this mortgage. We have assumed your payment due date is on the 1st of each month, and your lender charges a $50 late fee for a missed payment.

2. Your Credit Score Can Drop

After about 30 days of missing a payment, your lender reports it to the credit bureaus (Equifax and TransUnion). Once that happens, your credit score will likely drop. The longer you delay the payment, the more your credit score suffers.

3. Your Mortgage Could Go Into Default

If you still haven’t paid after 30 days, your mortgage officially goes into default. At this point, the lender can take legal action. Since your home serves as collateral, the lender has the right to reclaim it to recover losses. In Ontario, most lenders use a process called power of sale rather than foreclosure.

During a power of sale, your lender sends a formal notice giving you 35 days to catch up on missed payments. You can prevent further action by paying off the outstanding mortgage balance. However, if you fail to act within the 35 days, the lender can take ownership of your home and sell it to recover the remaining balance.

Can You Put Your Welland Home on the Market with Missed Payments?

Yes, you can sell your house in Welland even if you’re behind on your mortgage payments. In fact, selling voluntarily can be a smart move, especially if your lender hasn’t started a power of sale process yet. This way, you can avoid serious consequences, such as foreclosure, legal action, or damage to your credit score.

But before listing your Welland house for sale, it’s important to know how much equity you have. Equity is the difference between what your home is worth today and how much you still owe on your mortgage. If your home’s market value is higher than your remaining mortgage (positive equity), selling could cover your loan and leave you with extra cash.

You can estimate your equity using an online house value calculator in Canada. You can also get a professional appraisal report to get a more accurate idea of your home’s value. However, even if your equity is negative, selling is still an option.

Options for Selling Your House If You’re Late on Mortgage

➔ If You Owe Less Than Your Home’s Value = Positive Equity

When your mortgage balance is lower than what your home is worth, you have more options to sell. Here are your selling options:

1. List Your Home with a Real Estate Agent

The most common way to sell a house in this case is by working with a licensed real estate agent. A Realtor can help set the right price for your home based on the current market conditions. Realtors can also market your home effectively to reach serious buyers quickly. Additionally, when offers come in, your Realtor can negotiate to get the best possible price.

Certainly, selling your house with a Realtor may take a little longer than other methods. However, it usually ensures that you get closer to the full market value of your home.

2. Sell Directly to a Cash Buyer

If you need to sell quickly, a cash buyer can be a good option. Cash buyers are often investors or companies that specialise in homes in distress. They can close the sale much faster than a traditional buyer. This speed can help you avoid further late fees or penalties on your mortgage.

Keep in mind, though, that cash buyers typically offer less than market value. Hence, you might not receive all the equity in your home.

3. Consider a Rent-to-Own Agreement

Rent-to-own is another creative option for selling your house when behind on your mortgage payments. This option allows a buyer to rent your home with the option to buy later. You, the home seller, will receive monthly rent payments, which can help cover your mortgage arrears without waiting for a full sale. This option can work well when the market is slow or if you can’t find a buyer immediately.

➔ If You Owe More Than Your Home’s Value = Negative Equity

If your mortgage balance is higher than your home’s current value, selling becomes trickier. In real estate, we refer to this situation as negative equity or being underwater. In this case, you might need to pursue a short sale.

A short sale happens when your lender allows you to sell your home for less than your mortgage balance. Essentially, they write off a portion of your debt to avoid the costly and lengthy foreclosure or power of sale process.

Key Things to Know About Short Sales:

- Lender Approval is Required

Your lender must approve the sale price and terms. They will likely request detailed financial statements, proof of hardship, and an explanation of why you cannot continue paying the mortgage.

- Credit Score Impact

A short sale affects your credit score. But it is generally less damaging than a foreclosure or power of sale.

- Time Commitment

Short sales take longer because the lender must review and approve the entire home sale transaction.

Staying Put: Other Ways Than Selling

Don’t want to consider selling? The good news is that there are ways to keep your Welland house while catching up on missed payments. The first option is talking to your lender. The lender may be willing to temporarily lower your monthly payments or let you catch up on missed payments over time.

Another option is mortgage refinancing. Refinancing can lower your monthly payments or consolidate other debts, making finances more manageable. You can also consider renting out a part of your home. Choosing this option can provide extra income and allow you to retain your home.

However, whatever you do, acting early is key. Taking action earlier gives you control and more options to protect your home.