Managing accounts receivable in the U.S. has become more complex than ever. Rising customer expectations, subscription-based business models, and operational costs are putting pressure on finance teams. For many companies, delayed payments and inefficient processes directly impact cash flow and growth.

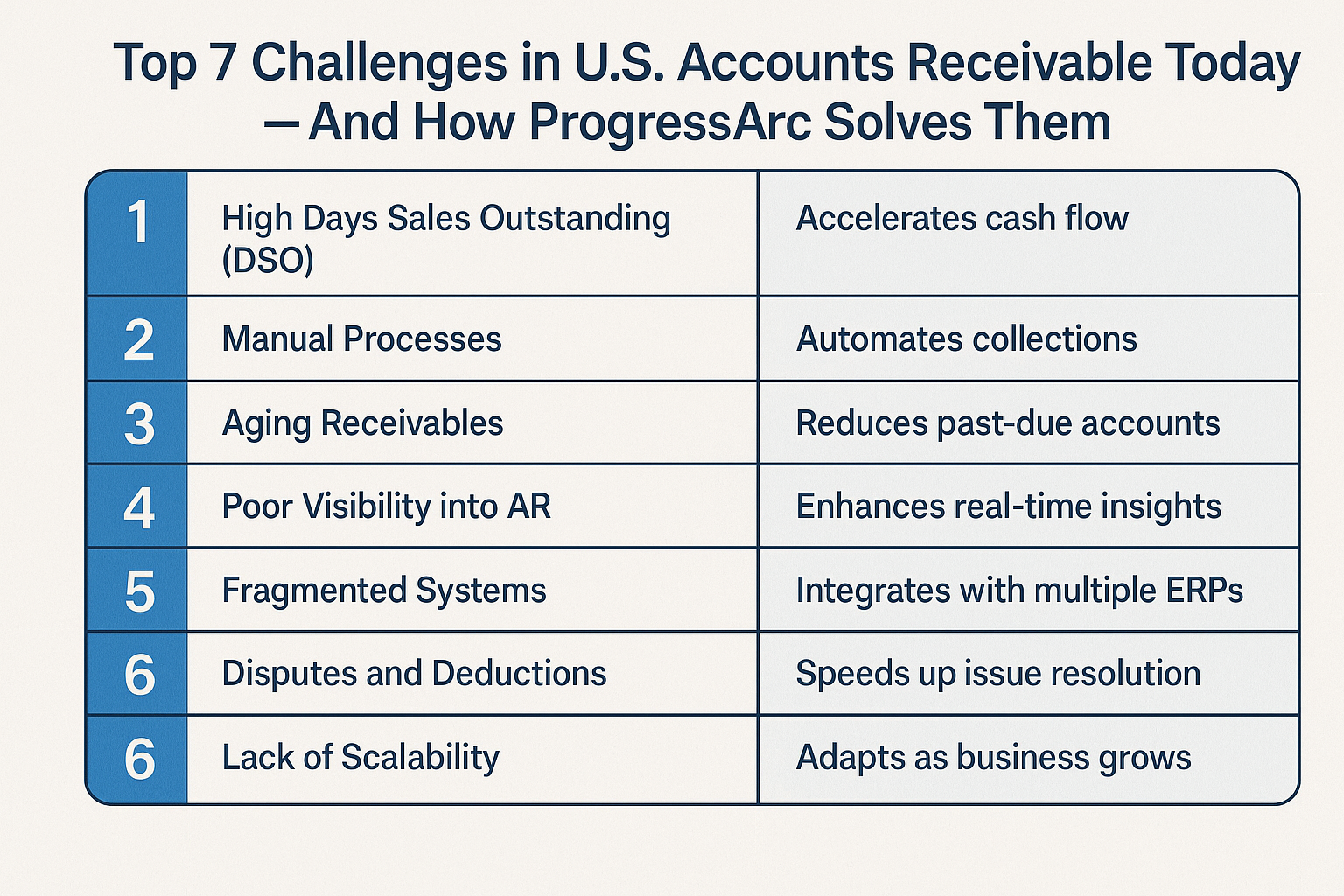

This is where outsourced accounts receivable services and accounts receivable management services play a critical role. Let’s explore the top seven challenges U.S. businesses face today—and how ProgressArc helps solve them.

1. Late Payments and Inconsistent Cash Flow

Late payments remain one of the biggest hurdles in accounts receivable. Manual follow-ups, lack of reminders, and poor tracking lead to revenue delays.

How ProgressArc helps:

By leveraging accounts receivable outsourcing services, ProgressArc automates follow-ups, invoicing, and collections—ensuring faster payments and predictable cash flow.

🔗 Learn more about our accounts receivable solutions:

2. Growing Subscription Billing Complexity

Subscription-based businesses struggle with recurring invoices, renewals, and failed transactions. Poor subscription payment processing leads to revenue leakage and churn.

How ProgressArc helps:

Our dedicated teams manage recurring and subscription billing efficiently, ensuring timely charges and accurate records.

🔗 Explore our recurring and subscription management services.

3. High Operational Costs

Hiring, training, and maintaining in-house AR teams is expensive—especially for scaling businesses.

How ProgressArc helps:

With outsourced accounts receivable services, companies reduce overhead while gaining access to skilled professionals who specialize in AR operations.

4. Poor Customer Communication

Ineffective communication during billing and collections damages customer relationships and brand trust.

How ProgressArc helps:

By combining customer service outsourcing services with AR management, we ensure polite, professional, and timely communication with customers—protecting both revenue and reputation.

🔗 Discover our customer service outsourcing services:

5. Manual Processes and Human Errors

Spreadsheets, emails, and disconnected systems lead to invoicing errors, missed follow-ups, and inaccurate reporting.

How ProgressArc helps:

We implement streamlined workflows and automation within our accounts receivable management services, reducing errors and improving accuracy.

6. Limited Visibility into AR Performance

Many businesses lack real-time insights into aging reports, overdue invoices, and collection efficiency.

How ProgressArc helps:

Our AR outsourcing model provides clear reporting, dashboards, and performance tracking—giving leadership full visibility into financial health.

7. Compliance and Data Security Risks

Handling financial data requires strict compliance with regulations and security standards.

How ProgressArc helps:

We follow industry best practices and secure processes, ensuring compliance while handling sensitive billing and payment information safely.

Why U.S. Businesses Choose Accounts Receivable Outsourcing

By adopting accounts receivable outsourcing services, businesses gain:

-

Faster payment cycles

-

Lower operational costs

-

Improved customer experience

-

Better subscription payment processing

-

Scalable financial operations

ProgressArc – Accounts Receivable Experts (USA, Irvine)

At ProgressArc, we specialize in outsourced accounts receivable services, accounts receivable management services, and customer service outsourcing services for U.S.-based businesses. Our integrated approach ensures smoother collections, stronger customer relationships, and healthier cash flow.

📍 Location: Irvine, USA

📧 Email: success@progressarc.io

📞 Phone: +1 (949)-216-0677