Introduction

The automotive speedometer market is a vital segment of the global automotive instrumentation and electronics industry, playing a critical role in vehicle safety, performance monitoring, and regulatory compliance. Speedometers provide real-time information on vehicle speed, enabling drivers to maintain control, follow traffic regulations, and ensure efficient driving behavior. From traditional analog needle-based displays to advanced digital and fully integrated instrument clusters, speedometer technology has evolved significantly over the years. The growing adoption of electronic control systems, digital dashboards, and connected vehicle technologies is reshaping the design and functionality of modern speedometers. Rising global vehicle production, increasing demand for passenger and commercial vehicles, and continuous innovations in automotive electronics are collectively driving steady expansion of the automotive speedometer market across both developed and emerging economies.

Market Drivers

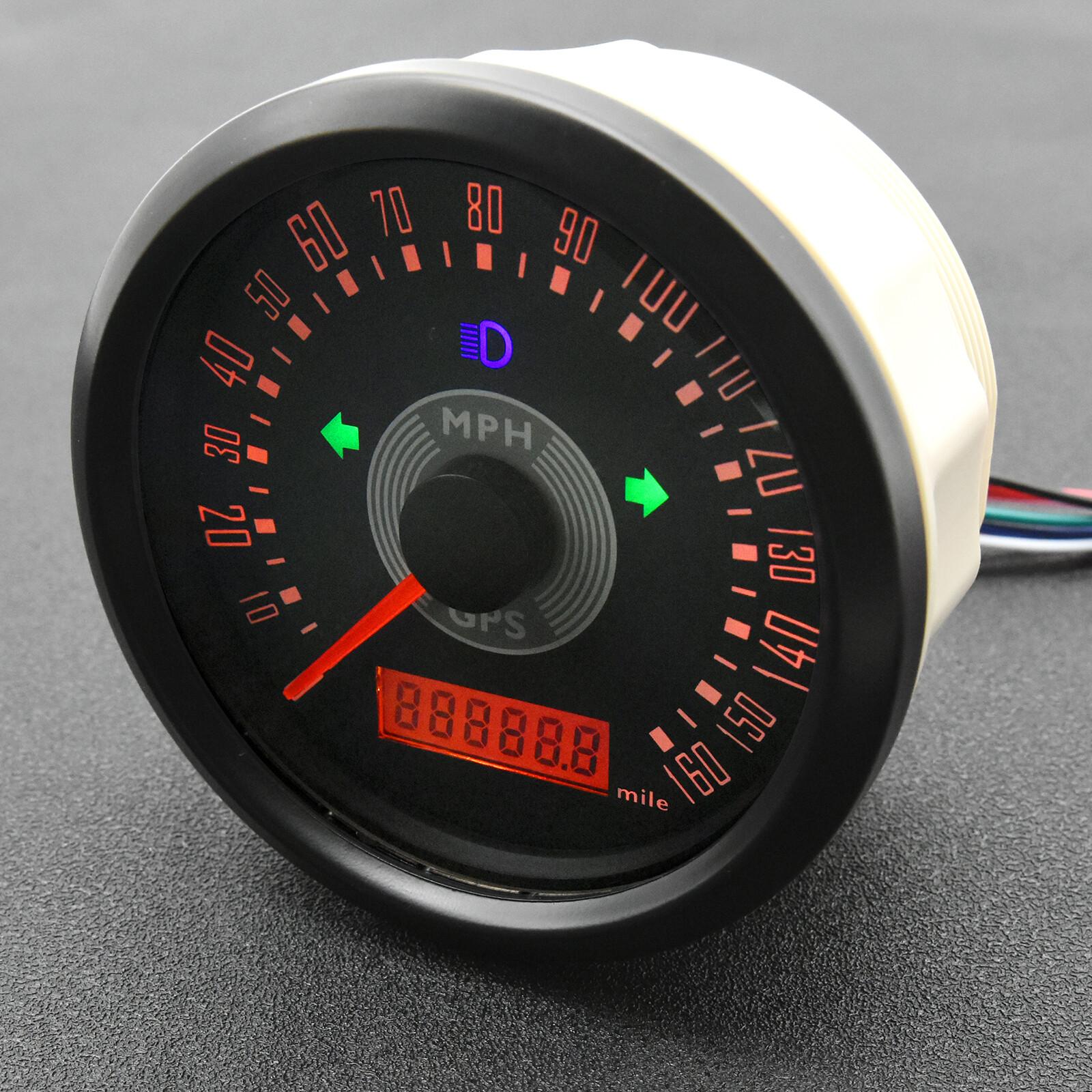

One of the primary drivers of the automotive speedometer market is the consistent growth in global vehicle production. Increasing demand for passenger cars, commercial vehicles, and two-wheelers directly boosts the installation of speedometers as mandatory safety equipment. Stringent government regulations and road safety standards across countries require accurate speed measurement and display systems in all vehicles, ensuring stable baseline demand for the market. Rapid advancements in automotive electronics, including the transition from mechanical to electronic and digital speedometers, are further accelerating market growth. The increasing adoption of digital instrument clusters, head-up displays, and advanced driver information systems is pushing automakers to integrate high-precision speed sensing and display technologies. Additionally, rising consumer preference for premium interior features, including customizable digital dashboards and infotainment integration, is elevating the demand for advanced speedometer systems even in mid-range and economy vehicles. Growth in electric vehicles, which rely heavily on digital instrumentation, is also supporting long-term market expansion.

Market Challenges

Despite steady growth, the automotive speedometer market faces several challenges. One major concern is cost pressure, particularly in price-sensitive markets where automakers aim to minimize component expenses to maintain competitive vehicle pricing. Advanced digital speedometer systems, while feature-rich, involve higher production and integration costs compared to conventional analog units. Technological complexity and rapid innovation cycles require continuous investment in research and development, which can strain smaller component manufacturers. The market is also highly dependent on overall automotive production trends, making it vulnerable to economic slowdowns, supply chain disruptions, and fluctuations in raw material availability. Additionally, maintaining measurement accuracy and long-term reliability of electronic speedometers under varying environmental and operating conditions remains a critical technical challenge. Cybersecurity and data integrity concerns related to fully digital and connected instrument clusters are emerging issues that manufacturers must address proactively.

Market Opportunities

The market presents strong growth opportunities through the rapid digitization of vehicle interiors and the increasing penetration of connected car technologies. Fully digital instrument clusters, which integrate speedometer functions with navigation, vehicle diagnostics, and driver assistance information, are gaining popularity across multiple vehicle segments. The expansion of electric and hybrid vehicle production offers another significant opportunity, as these vehicles predominantly utilize advanced digital displays with high-precision electronic speed sensing. Emerging markets in Asia, Latin America, and Africa are witnessing rising vehicle ownership and improving road infrastructure, creating fresh demand for both OEM-fitted and aftermarket speedometers. The aftermarket segment itself offers lucrative potential, driven by replacement demand, vehicle customization trends, and the growing popularity of digital upgrade kits for older vehicles. Furthermore, the integration of artificial intelligence, augmented reality displays, and vehicle-to-infrastructure communication systems is expected to open new avenues for next-generation speedometer solutions.

Regional Insights

Asia-Pacific dominates the automotive speedometer market due to its massive automotive manufacturing base and high vehicle sales volume. Countries such as China, India, Japan, and South Korea collectively account for a significant share of global vehicle production, directly supporting strong demand for speedometer systems. China remains the largest contributor driven by its extensive passenger car, electric vehicle, and commercial vehicle manufacturing capacity. North America represents a mature and technologically advanced market, supported by high penetration of premium vehicles, strong adoption of digital instrument clusters, and continuous innovation in automotive electronics. Europe also holds a substantial market share, driven by strict safety regulations, rapid electrification, and strong demand for high-end automotive display technologies. The Middle East & Africa and Latin America are emerging regions, gradually gaining traction due to improving economic conditions, infrastructure development, and increasing vehicle imports and local assembly operations.

Future Outlook

The future of the automotive speedometer market is strongly aligned with the broader transformation of the automotive industry toward electrification, connectivity, and digitalization. Mechanical and analog speedometers are expected to continue their gradual decline as digital and fully electronic systems become the industry standard. Integration of speedometers into multifunctional digital instrument clusters and head-up displays will dominate future vehicle cockpit designs. The growing use of advanced driver assistance systems and semi-autonomous driving technologies will further increase the need for highly accurate and responsive speed measurement and display systems. Software-defined vehicles and over-the-air update capabilities are expected to influence speedometer functionality, allowing real-time feature upgrades and performance enhancements. As vehicles move closer to fully autonomous operation, speed display may evolve from a purely driver-centric function into a shared autonomous system interface supporting safety, diagnostics, and regulatory compliance. Overall, the market is expected to witness sustained technological evolution and stable long-term growth.

Conclusion

The automotive speedometer market remains an essential part of the global automotive ecosystem, supporting vehicle safety, regulatory compliance, and driving efficiency across all vehicle categories. Growth is being driven by rising global vehicle production, strict government safety norms, rapid advancements in automotive electronics, and the widespread shift toward digital vehicle interiors. While challenges such as cost pressures, technological complexity, and market dependence on overall vehicle sales persist, emerging opportunities in electric vehicles, connected cars, and the aftermarket continue to strengthen the market outlook. Regional trends highlight Asia-Pacific as the dominant production hub, while North America and Europe drive technological innovation and premium adoption. As the automotive industry continues its transformation toward smarter, more connected, and software-driven vehicles, the role of the automotive speedometer will expand beyond simple speed display to become an integrated component of next-generation vehicle information systems.