Market Overview

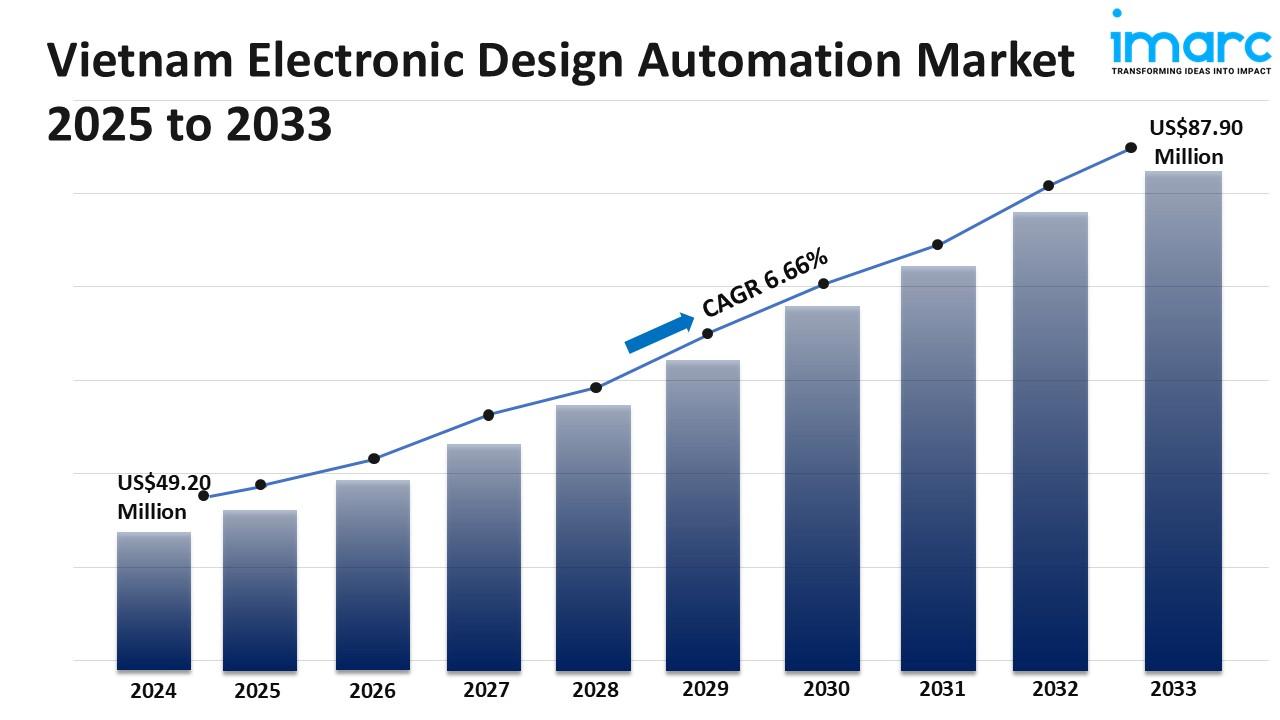

The Vietnam electronic design automation market size was USD 49.20 Million in 2024 and is forecast to reach USD 87.90 Million by 2033. The market is expected to grow at a CAGR of 6.66% during the forecast period from 2025 to 2033. Growth is driven by the country's expanding semiconductor manufacturing capacity, increased investment from international technology companies, and a growing talent pool in electronics engineering. Rising demand for consumer electronics, IoT products, and embedded systems fuels the need for advanced design tools, supported by government initiatives and emerging technology parks in key cities.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

Vietnam Electronic Design Automation Market Key Takeaways

- Current Market Size (2024): USD 49.20 Million

- CAGR (2025-2033): 6.66%

- Forecast Period: 2025-2033

- The market is fueled by the semiconductor manufacturing capacity of Vietnam and increased investment by international tech companies.

- Demand growth is supported by consumer electronics, IoT, and embedded systems requiring sophisticated design tools.

- Government initiatives and emerging technology parks in Ho Chi Minh City and Da Nang accelerate design innovation.

- Growing local talent pool and increased industry-academic collaborations are enhancing skills relevant to electronics design.

- The rising presence of startups and design service firms offering chip design outsourcing boosts market growth.

- EDA tools are increasingly adopted for smart home appliances, healthcare, and industrial IoT systems development.

Sample Request Link: https://www.imarcgroup.com/vietnam-electronic-design-automation-market/requestsample

Market Growth Factors

Growth in Vietnam's electronic design automation industry is driven by increasing investments in capital in Vietnam's semiconductor and chip design sector. The effort to diversify the global semiconductor supply chain has made the country a destination for electronics and semiconductor companies engaged in manufacturing and R&D for global technology firms. Another reason for this sort of growth is that these companies are increasingly investing in high-tech parks in Ho Chi Minh City and Da Nang, where infrastructure and policies are not lacking. Therefore, it is likely that demand for design verification tools, SoC design tools and IC design tools will follow. Alternatively, an R&D or engineering design organizational unit designing electronic chips/ICs with a very high level of complexity requires EDA software to improve accuracy, speed, and meet standards set by semiconductor industry associations.

Another factor is the improved availability of local skilled and trained personnel: Vietnamese technical colleges and universities offer VLSI design, circuit simulation, design verification and test, and digital systems as part of electronics engineering programs, where EDA tools are required. There is also a trend for partnerships between local institutions and overseas EDA software companies, and training and certification of students while they are still studying. Trained and certified graduates are recruited by local start-up and design services companies, which also contract out chip and PCB design services to overseas clients. Innovation centers and hackathon events, as well as government sponsored research grant programs to promote electronics design and adoption of EDA tools, are helping to integrate Vietnam into the global semiconductor and electronics value chain.

With the increasing complexity of EDA applications such as consumer electronics and Internet of Things (IoT) devices, a growing need has arisen for electronic components and designs to be designed and tested. Vietnam has emerged as an electronics manufacturing hub for smart phones, wearable technologies and major appliances. The application of EDA tools allows simulation, bug fixing, and validation of reliability in advance, which is vital in an industry where a product's life cycle is short and its design must be precise and rapid. Thus, there is a demand for EDA tools to design smart home appliances, health monitoring devices, and industrial Internet of Things (IoT). The high growth in the country for very active start-up companies focused on the design and manufacture of low-cost, consumer electronics creates a strong need for EDA tools to reduce time to market and improve competitiveness.

Market Segmentation

Solution Type Insights:

- Semiconductor IP: Integral intellectual property components essential for chip design, facilitating reuse and faster development.

- CAE (Computer Aided Engineering): Tools that assist in engineering design, simulation, and analysis to enhance product development efficiency.

- IC Physical Design and Verification: Solutions focusing on physical layout and verification of integrated circuits to ensure design accuracy.

- PCB and MCM (Printed Circuit Board and Multi-Chip Module): Tools for designing and verifying printed circuit boards and multi-chip modules critical in electronics assembly.

- Services: Support services including consulting, design assistance, training, and maintenance related to electronic design automation.

Deployment Type Insights:

- On-premises: EDA software deployed locally on company servers and infrastructure, providing control over data and customization.

- Cloud-based: EDA tools delivered over the internet enabling accessibility, scalability, and collaboration through cloud platforms.

End-Use Industry Insights:

- Military/Defense: EDA applications in designing advanced electronics and semiconductor technologies for defense systems.

- Aerospace: Tools used in developing electronics critical to aircraft, spacecraft, and related aerospace industries.

- Telecom: Solutions supporting the design of telecom equipment and semiconductor devices.

- Automotive: EDA tools for the automotive sector focused on embedded systems, sensors, and electronic control units.

- Healthcare: Applications in medical device electronics and healthcare technologies.

- Others: Include various additional industries leveraging EDA tools for electronics design.

Regional Insights

The Vietnam electronic design automation market is segmented into Northern Vietnam, Central Vietnam, and Southern Vietnam. The report does not specify the dominant region or precise market statistics for each area. However, significant activity is noted in regions like Ho Chi Minh City (Southern Vietnam) and Da Nang (Central Vietnam), where technology parks foster growth and innovation. These hubs attract international technology investments and facilitate the adoption of advanced EDA solutions, driving steady market expansion across regions.

Recent Developments & News

Not provided in source.

Key Players

Competitive Landscape

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Customization Note

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302