DataM Intelligence’s latest report, “Aluminum Gallium Arsenide Market Size, Share, Industry, Forecast & Outlook (2024–2031),” highlights the strong rise of the global Aluminum Gallium Arsenide (AlGaAs) Market. The market was valued at US$ 1.9 billion in 2023 and is projected to reach US$ 4.2 billion by 2031, growing at a robust CAGR of 10.2%.

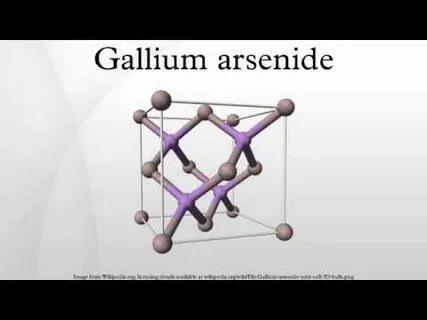

AlGaAs, a high-performance III-V semiconductor material, is increasingly used in semiconductor lasers, photonic integrated circuits, high-speed communication devices, solar cells, and optoelectronic systems—driving widespread adoption across electronics, aerospace, medical, and renewable energy sectors.

Get a Free Sample PDF Of This Report (Higher Priority for Corporate Email ID):

https://www.datamintelligence.com/download-sample/aluminum-gallium-arsenide-market?sai-v

Market Segmentation Insights

The Aluminum Gallium Arsenide Market is segmented by:

By Purity

-

99.0%

-

99.9%

-

99.99% (dominant for high-end photonics & semiconductor applications)

By Application

-

Semiconductor Lasers

-

Integrated Circuits (ICs)

-

Photovoltaics

-

LED & Display Technologies

-

Optical Sensing & Imaging

-

Spectroscopy

-

Research & Laboratory Use

By End-User

-

Electronics

-

Telecommunications

-

Photonics

-

Aerospace & Defense

-

Medical & Healthcare

-

Academic & Industrial Research

By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

Asia-Pacific continues to lead growth due to rapid expansion in semiconductor manufacturing and telecom infrastructure. North America remains a major hub for aerospace, defense applications, and next-generation photonics research.

Regional Insights

-

Asia-Pacific is the fastest-growing region due to rising demand for photonic devices, 5G components, and semiconductor R&D in China, Japan, South Korea, and India.

-

North America maintains a strong market presence driven by adoption of advanced lasers, defense systems, and optoelectronic innovations.

-

Europe benefits from investments in renewable energy, satellite communication, and industrial photonics.

Industry Trends & Recent Developments (2025)

-

Rapid adoption of photonic integrated circuits (PICs) in telecom networks and data centers.

-

Growing use of AlGaAs in high-efficiency solar cells for aerospace and renewable energy applications.

-

Major advances in MBE and MOCVD growth technologies, improving purity and structural precision.

-

Increased R&D investments in quantum photonics, semiconductor lasers, and mid-infrared sensing devices.

-

Expansion of production facilities by materials and wafer manufacturers to meet global semiconductor demand.

Competitive Landscape: Key Players

The Aluminum Gallium Arsenide Market is characterized by strong competition among semiconductor material manufacturers and photonics companies. Key players include:

-

Sumitomo Electric Industries Ltd.

-

ALB Materials Inc.

-

Umicore

-

AXT Inc.

-

IQE plc

-

Furukawa Electric Co. Ltd.

-

Ganwafer

-

Wafer Technology Ltd.

-

EMCORE Corporation

-

XI’AN Function Material Group Co. Ltd.

These companies focus on high-purity wafer production, epitaxial growth technologies, and strategic supply chain partnerships to support telecom, aerospace, and research sectors.

Strategic Outlook

The Aluminum Gallium Arsenide Market is positioned for strong long-term expansion driven by:

-

Rising adoption of optoelectronic devices

-

Growth in 5G/6G communication infrastructure

-

Increasing use of photonic chips in AI and cloud computing

-

Development of high-efficiency photovoltaic systems

-

Advancements in quantum communication and sensing

Companies investing in high-purity wafer technologies, scalable production, and innovative photonic solutions are expected to dominate the future market landscape.

Research Methodology

The report is developed using extensive quantitative and qualitative analysis, combining:

-

Primary interviews with industry experts

-

Secondary data from scientific papers, industry journals, and corporate filings

-

Market modeling and forecast analysis

-

Competitive benchmarking

-

Technology trend assessment