Global 3D Printing Automotive Market: Industry Analysis and Forecast (2025–2032)

Market Overview

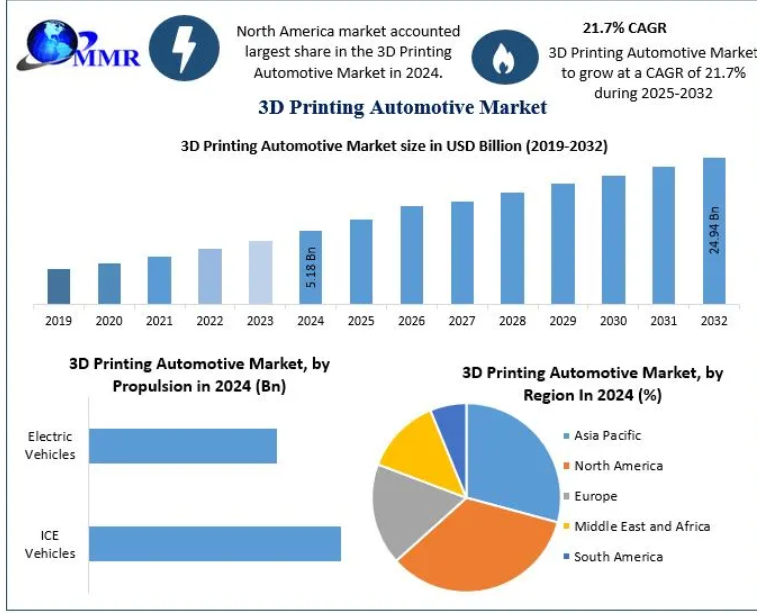

The Global 3D Printing Automotive Market was valued at USD 5.18 billion in 2024 and is expected to reach USD 24.94 billion by 2032, growing at an impressive CAGR of 21.7% during the forecast period (2025–2032).

The integration of 3D printing technologies into the automotive manufacturing ecosystem is transforming how vehicles are designed, prototyped, tested, and produced. Advanced industrial 3D printing software enables engineers to create complex, lightweight, and customizable components with unprecedented precision and speed. This technology is driving cost efficiency and flexibility, making it a game changer for the global automotive sector.

Market Definition

3D printing in the automotive industry, also known as additive manufacturing, involves creating three-dimensional objects from digital models by layering materials such as polymers, metals, or composites. This process is used for rapid prototyping, tooling, component manufacturing, and even end-use part production. As vehicle design becomes increasingly digital, 3D printing offers a path toward on-demand production, reduced waste, and faster innovation cycles.

Download a Free Sample Report Today:https://www.maximizemarketresearch.com/request-sample/9760/

Market Dynamics

Drivers

-

Rising Investments by Automotive OEMs:

Major automakers are integrating 3D printing into their production lines to reduce costs and shorten time-to-market. Leading OEMs such as Ford, BMW, and Volkswagen are leveraging additive manufacturing for prototyping and small-batch production. -

Enhanced Design Flexibility and Cost Efficiency:

3D printing allows automotive manufacturers to test complex designs rapidly, minimizing errors and material wastage. This results in faster innovation, lightweight components, and improved vehicle performance. -

Technological Advancements and R&D Expansion:

Continuous advancements in materials science, software, and 3D printing hardware are expanding the range of printable automotive components. Companies such as Stratasys, 3D Systems, and EOS GmbH have heavily invested in developing next-generation technologies.

Restraints

-

High Equipment and Material Costs:

The cost of metal 3D printers and high-quality printing powders remains a major obstacle for large-scale adoption. The inefficiency in current powder production—yielding only 50% usable material—further adds to expenses. -

Technical Limitations:

3D printing currently struggles to produce large components and mix materials within a single build. Moreover, mass production of metal parts remains more feasible with conventional manufacturing techniques.

Opportunities

-

Emerging Applications in Electric Vehicles (EVs):

The EV revolution presents new opportunities for 3D printing, as manufacturers seek lightweight, thermally efficient, and customizable parts. -

Untapped Adjacent Markets:

The evolution of additive manufacturing from rapid prototyping to direct digital manufacturing (DDM) is creating new commercial opportunities across automotive, aerospace, and consumer goods industries.

Segment Analysis

By Application

-

Prototyping & Tooling

-

Research, Development & Innovation

-

Manufacturing Complex Components

-

Others

The Prototyping & Tooling segment dominated the market in 2024 and is expected to maintain its lead through 2032. 3D printing accelerates prototype creation, allows design flexibility, and reduces waste — making it a critical tool in automotive R&D.

By Technology

-

Stereolithography (SLA)

-

Selective Laser Sintering (SLS)

-

Electron Beam Melting (EBM)

-

Fused Deposition Modeling (FDM)

-

Laminated Object Manufacturing (LOM)

-

Three-Dimensional Inkjet Printing

-

Others

Stereolithography (SLA) held the largest market share in 2024. Known for its precision, smooth surface finish, and material versatility, SLA is widely used for creating intricate prototypes and functional components. Its adoption by companies such as Gillette and General Motors underscores its industrial viability.

By Propulsion

-

ICE Vehicles

-

Electric Vehicles

While Internal Combustion Engine (ICE) vehicles currently dominate, the Electric Vehicle (EV) segment is expected to exhibit the fastest growth. 3D printing supports the development of lightweight EV parts, such as battery housings and cooling systems, enhancing overall energy efficiency.

Download a Free Sample Report Today:https://www.maximizemarketresearch.com/request-sample/9760/

Regional Insights

North America

North America accounted for a major share of the global market in 2024, led by the United States, which houses hundreds of automakers and startups adopting 3D printing for both ICE and EV manufacturing. Continuous technological advancements, strong R&D investments, and the presence of key players like 3D Systems, Stratasys, and Desktop Metal drive regional dominance.

Europe

Europe is expected to emerge as the fastest-growing regional market, with Germany, the UK, and Sweden leading adoption. Prominent automakers such as BMW, Volkswagen, and Mercedes-Benz are using additive manufacturing for R&D and production optimization. Moreover, environmental regulations encouraging waste reduction are further propelling adoption.

Asia-Pacific

Asia-Pacific’s growth is fueled by rapid industrialization, rising automotive production in China, Japan, and South Korea, and government initiatives promoting advanced manufacturing. Increasing interest in electric mobility and customized automotive design is likely to boost regional market expansion.

Competitive Landscape

The global 3D printing automotive market is moderately consolidated, with key players focusing on innovation, partnerships, and mergers to enhance their product portfolios and expand geographic reach.

Key Players include:

-

3D Systems Corporation (US)

-

Autodesk, Inc. (US)

-

Envisiontec Inc. (US)

-

Stratasys Ltd. (Israel)

-

EOS GmbH (Germany)

-

Materialise NV (Belgium)

-

HP Inc. (US)

-

Arcam AB (Sweden)

-

Desktop Metal, Inc. (US)

-

General Electric Company (US)

-

Ultimaker BV (Netherlands)

-

Renishaw plc (UK)

-

Voxeljet AG (Germany)

-

Sanya Si Hai (India)

-

Hanhook Tires (South Korea)

These companies are investing heavily in material innovation, cloud-based design platforms, and AI-enabled 3D printing to stay competitive in the evolving automotive landscape.

Key Takeaways

-

Market Size (2024): USD 5.18 Billion

-

Forecast (2032): USD 24.94 Billion

-

CAGR (2025–2032): 21.7%

-

Leading Segment: Prototyping & Tooling

-

Dominant Technology: Stereolithography (SLA)

-

Top Growth Region: Europe

Conclusion

The 3D Printing Automotive Market is at the forefront of the automotive industry's digital transformation. With rapid advancements in materials, software, and manufacturing technology, 3D printing is revolutionizing the way vehicles are designed and built. As OEMs embrace this technology to enhance efficiency and sustainability, additive manufacturing will become a core enabler of next-generation mobility — shaping the future of automotive production from design to delivery.