IMARC Group has recently released a new research study titled “South Korea Domestic Courier, Express, and Parcel (CEP) Market Report by Business Model (Business-to-Business (B2B), Business-to-Customer (B2C), Customer-to-Customer (C2C)), Type (E-Commerce, Non E-Commerce), End User (Services, Wholesale and Retail Trade, Healthcare, Industrial Manufacturing, and Others), and Region 2025-2033”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

South Korea Domestic Courier Express Parcel (CEP) Market Overview

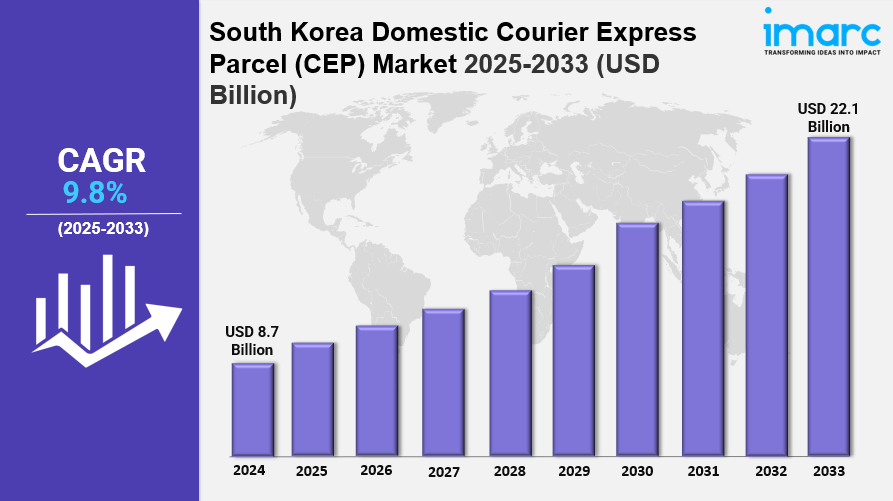

The South Korea Domestic Courier Express Parcel (CEP) market reached a size of USD 8.7 billion in 2024. It is expected to grow at a CAGR of 9.8% during the forecast period from 2025 to 2033, reaching USD 22.1 billion by 2033. Market growth is driven by the rapid expansion of the ecommerce industry, advancements in logistics infrastructure, urbanization, and rising consumer preference for same-day and next-day delivery. Favorable government regulations also support this growth.

Study Assumptions Years

- Base Year: 2024

- Historical Year: 2019-2024

- Forecast Year: 2025-2033

South Korea Domestic Courier Express Parcel (CEP) Market Key Takeaways

- 2024 Market Size: USD 8.7 billion

- CAGR: 9.8%

- Forecast Period: 2025 to 2033

- The fast-growing ecommerce industry in South Korea is significantly boosting demand for domestic CEP services.

- Advanced logistics and transportation infrastructure developments enable seamless CEP operations, fostering market growth.

- Increasing urbanization and construction of new cities create additional opportunities for domestic courier services.

- Consumer preference for same-day and next-day delivery is driving higher demand for express services.

- The adoption of AI, machine learning, and data analytics is enhancing route planning and operational efficiency.

- Favorable government regulations and incentives accelerate the expansion of CEP services nationwide.

Sample Request Link: https://www.imarcgroup.com/south-korea-domestic-courier-express-parcel-market/requestsample

Market Growth Factors

The South Korea Domestic Courier Express Parcel (CEP) market size is propelled by the rapid growth of the ecommerce sector, which increases the volume of parcels requiring delivery. According to the report, the CEP market size was USD 8.7 billion in 2024 and is projected to reach USD 22.1 billion by 2033 at a CAGR of 9.8%. This growth is underpinned by the rising consumer demand for timely delivery, supported by enhanced logistics and transportation infrastructure development that facilitates efficient CEP operations.

Urbanization trends further boost market opportunities, as the construction of new cities increases the demand for domestic parcel delivery services. Additionally, the growing consumer preference for same-day and next-day delivery options significantly strengthens the demand for express parcel and courier services across the country. This shift towards faster delivery reflects changing consumer expectations and demands in South Korea.

The adoption of cutting-edge technologies such as artificial intelligence (AI), machine learning (ML), and data analytics has revolutionized route planning and operation efficiencies in the CEP market. The report emphasizes the role of these technologies in improving delivery speed and optimizing logistics networks. Moreover, government support through favorable regulations and incentives fosters a conducive environment for CEP growth, enabling wider market penetration and enhancing service quality across South Korea.

Market Segmentation

Business Model:

- B2B (Business to Business): Services facilitating parcel delivery between businesses within the country.

- B2C (Business to Consumer): Courier services catering to deliveries from businesses to individual consumers.

- C2C (Consumer to Consumer): Parcel services enabling deliveries directly between consumers.

Type:

- E-commerce: Courier services for online retail shipments.

- Non-e-commerce: Delivery services outside of online retail transactions.

End User:

- Services: CEP services supporting the service industry deliveries.

- Wholesale & Retail: Parcel delivery facilitating wholesale and retail trade.

- Healthcare: Specialized delivery services for the healthcare industry.

- Industrial Manufacturing: CEP services targeted toward manufacturing sectors.

- Others: Various other sectors utilizing domestic CEP services.

Regional Insights

The report segments the South Korean domestic CEP market into regions including Seoul Capital Area, Yeongnam (Southeast), Honam (Southwest), Hoseo (Central), and Others. Notably, the Seoul Capital Area dominates market activities supported by dense urbanization and intensive ecommerce adoption. Detailed statistics such as exact market shares or regional CAGR are not provided in the source. This regional distribution allows for targeted market strategies addressing each area's logistics and consumer demands.

Competitive Landscape

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Customization Note

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302